HSBC launches digital personal loans using Amount’s tech

HSBC launched a digital personal loan product for U.S. consumers on Monday in an effort to improve the efficiency of the underwriting process and respond to customer demand for a digital personal loan option. The global banking giant is using tech company Amount‘s platform to support the digital loan product.

“This was important for us to do as we scale up the size of HSBC’s retail [offering] and capabilities,” said Pablo Sanchez, head of retail banking and wealth management at HSBC USA. “There’s been about a 23% to 24% compounded annual growth rate in personal loans over the last five years, and we wanted to participate in that.”

HSBC joins other large banks and financial companies that are offering quick, digitally-enabled lending solutions to solve for small-dollar capital needs, such as home renovations. For instance, Marcus by Goldman Sachs rolled out digital home improvement loans last year, and non-banks like SoFi and Earnest offer similar products. Sanchez explained that the digital personal loan is for individuals who typically need around $17,000 on average, although loan sizes can be $35,000 or higher depending on the circumstances.

The differentiator for HSBC is Amount’s technology, which is able to make a quick credit decision based on a soft credit pull and other data points it’s able to consider. “Amount is providing the technology and the analytical horsepower and capability to our partners to help them improve their own digital capabilities,” said Amount CEO and co-founder Al Goldstein, noting that institutions are adding these types of tech-enabled tools to cater to customers who are expecting an Amazon-style user experience when looking for a personal loan.

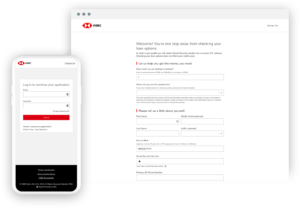

According to HSBC, the platform can make near-immediate loan decisions based on a customer’s name, contact information, data of birth and social security number; the loans are funded the next business day. Amount’s fraud platform also is able to quickly cross-check customer information. “They key is to use as much data that’s available within the constraints that the banks operate in,” said Goldstein.

See also: Amount, a fintech startup, signs deal with TD Bank in digital personal lending

HSBC previously offered small lines of credit, but customers had to be existing HSBC customers in order to apply. The new offering, however, is open to anyone and addresses credit needs that are smaller than those that would require a home equity line of credit, which typically has a more lengthy assessment process.

Alyson Clarke, principal analyst at Forrester Research, said the product is a win for the fintech startup as well as the bank. It will allow Amount to expand its reach among enterprise customers and help the bank get to market faster with the new offering, she noted.

Amount is a technology platform company that spun out of digital lender Avant, which offers direct-to-consumer loans. By offering its technology to other companies, Amount is able to grow its reach beyond direct-to-consumer models. Amount has worked with other large banks, including TD Bank, a relationship that went public earlier this year, and Regions Bank, with which it began working in 2016.