With Honey, PayPal focuses on the path to purchase

On Wednesday, PayPal agreed to acquire digital coupon platform Honey for $4 billion. Despite the hefty price tag, Honey offers PayPal data on customer intent, deepening the company’s foray into e-commerce and arming it with a new lever to drive transactions.

In a statement, Dan Schulman, PayPal CEO, called the acquisition among the most transformative in the company’s history, helping the company drive engagement and consumer loyalty to merchants on its platform.

Honey offers PayPal two strategic benefits: It offers access to a trove of customer data, and it could help PayPal increase activity on its payment systems.

According to PayPal, Honey’s capabilities will now become available to the company’s 300 million active accounts, along with 24 million merchant accounts. It moves PayPal’s focus beyond checkout, reaching customers at the beginning of their shopping journeys. In turn, Honey will allow PayPal to deliver personalized offers to consumers as they search for products.

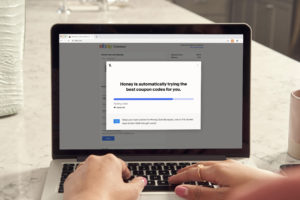

Founded in 2012, Honey acts as a desktop browser extension and app which finds discounts during a customer’s purchase process. The company also offers rewards points for purchases at partner brands, along with a tool that monitors price fluctuations of goods. It has 17 million monthly active users, according to PayPal, and generated $100 million in revenue in 2018.

Andrew Lipsman, e-commerce and retail analyst at eMarketer, told Bank Innovation PayPal’s Honey acquisition is part of a bigger trend among e-commerce players that are trying to get a holistic view of consumer purchase patterns. With data on customer intent and the factors that drive conversions, PayPal improves its value proposition to brands as well as consumers.

See also: PayPal: 15m Venmo users engaged in ‘monetizable transactions’

“The context here with all the big players in digital [commerce], is that the ones that are playing at the top of the funnel are trying to move to the bottom of the funnel, and the ones at the bottom are trying to move to the top,” said Lipsman. “[PayPal] is seeing transactions, but they have little visibility into what’s leading up to that. [With Honey,] there’s a ton of information of value that PayPal can use to understand how and why people are transacting.”

PayPal also noted that it intends to embed some of Honey’s capabilities into PayPal and Venmo apps. Adding discounts to its digital payment vehicles through Honey could act as an incentive to increase usage of its digital wallets.

“What we’ve seen in mature payments markets like the U.S. is that humans are creatures of habit and are conditioned to pay with plastic,” said Dayna Ford, a research director at Gartner. “If there is the possibility of getting additional rewards through Honey [via digital wallets], that could be the incentive that gets consumers over the hump and start to change their behavior.”