How TD Canada Trust is personalizing its in-app experience

As customers navigate through TD Canada Trust’s digital banking platform, the bank is looking to data analytics tools to make customer experiences more relevant. With reams of data on customer behavior, TD turned to Canadian tech company Flybits five years ago, and it’s looking to grow its capabilities to personalize digital banking experiences.

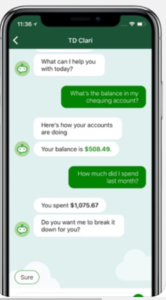

Based on customer attributes like spending patterns and other banking transactions, TD is able to modify the customer journey for each individual user, according to Vipul Lalka, vice president of TD’s payments platform and capabilities. “We leverage Flybits to digitally modify the experience for our customers in real time,” he explained, adding that TD is careful to determine the “right moment” for the customer to receive a message from the institution.

For example, if a customer is pre-authorized to upgrade their credit card limits, the app is able to send them push notifications notifying them of their eligibility to receive the offer. It’s also able to send customers informational messages and advice about products that may be relevant to their transactions and browsing behaviors.

See also: TD Focuses on Voice, Mobile to Drive Bank Transformation

According to Lalka, the advantage of using Flybits’ technology is it allows the bank to safeguard the trust of the consumer. Flybits doesn’t hold customer data, but its platform is able to make sense of it to personalize digital interactions. Meanwhile, all personal data stays at the bank. Instead, Flybits sees a list of randomized numbers that correspond to customers or customer groups.

“We completely distribute the data and, instead of moving the data, we ask questions from the data,” said Hossein Rahnama, CEO of Flybits. “We have done a lot of work, especially on the data layer and ad portfolio, to make sure that we can [enable] very high-impact personalization when we have no idea who the customer is.”

While TD has made advances in its efforts to tailor experiences for customers, bringing all of its data together from various platforms is an ongoing challenge, Lalka noted. The company’s work with Flybits and recently acquired AI company Layer 6 are helping the bank with its data management efforts. “The challenge is that we have a data ecosystem [that] is all over the place,” he said. “So there’s a huge exercise trying to aggregate that data.”

Another challenge, Lalka explained, is creating contextual interactions that aren’t considered “creepy” or intrusive. “We don’t want to be big brother,” he emphasized. “Our objective is how do we get more engaged with the customer [in a way] that is meaningful but still maintaining what we are known for, which is a trusted brand.”

Tiffani Montez, senior analyst at Aite Group, noted that, by working with Flybits, large banks like TD are moving away from a “mass market” approach to customer engagement and reaching customers with messages and offers that are relevant to their situations. Indeed, banks like TD are no longer treating their customers as if they’re one out of a million customers, but as individuals who need tailored offers and advice. “Trust is the endgame of creating value,” she added.

Bank Innovation Build, on Nov. 6-7 in Atlanta, helps attendees understand how to “do” innovation better. It is designed to offer best practices, to guide the innovation professional to better results. Register here.