Mysemenos: Temenos and Misys, dead end for the merger deal

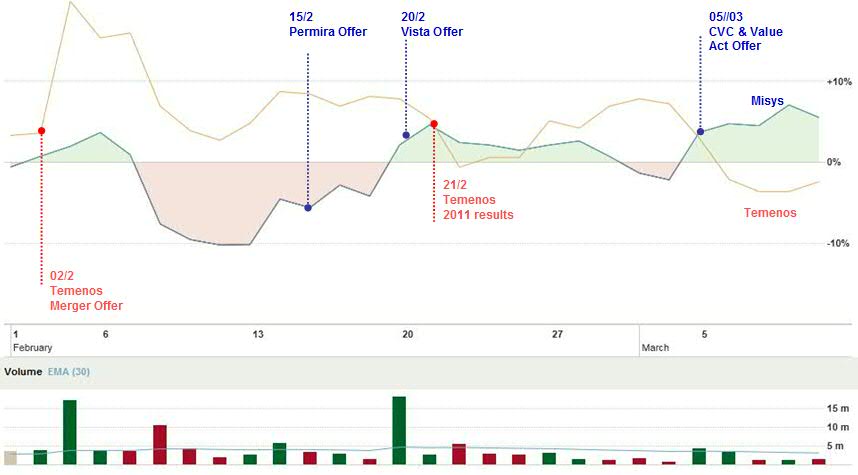

After five weeks of extenuating negotiations, with dramatic scenes entries and bumpy price rides on the stock market, the negotiations between Temenos and Misys seem to have come to an end, the companies announced today.

What will happen with Temenos now that a nice and bright horizon with Misys is not longer part of its future? The answer is a slow market, increased costs due to the still-hard-to-digest Odyssey acquisition and the certitude that T24, the flag-ship from Temenos, is getting close of its limits in terms of technical upgrade-ability.

Misys also faces its share of problems: declining margins and delayed decisions by its major clients. Moreover, the company faces the challenge of convincing the market that BankFusion really is the future of Core Banking. Whether Misys will do better without the “sales savoir-faire” from its Swiss rival will be determined in the next quarters. Already today Misys’ share price has in case Misys gets cold feet again.

According to another press release today, Misys continues to be in discussions with Vista Equity Partners as set out in the announcement dated 20 February 2012 and CVC Capital Partners Limited and ValueAct Capital (as joint offeror) as set out in the announcement dated 5 March 2012. Both bids entail possible cash offers for Misys.