How a small NH bank quadrupled its online account applications

Mascoma Bank increased its online account applications by 400%, thanks to a revamped online application process that rolled out in April.

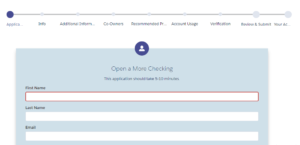

The Lebanon, N.H.-based bank turned to the banking software company nCino to design a digital banking experience that didn’t rely on paperwork. Customers send identity verification documents through Mascoma’s digital platform, cutting down application time from 45 minutes to less than 10 minutes.

According to Raphael Reznek, chief information officer at Mascoma, the online application is important for rural bank customers who might not have time to drive to a branch. “If [customers] have to stop to gather data before they can continue, they are likely to abandon the process,” Reznek said. “The younger customer base is used to a more seamless experience, and this helps with that.”

In addition, the bank improved its back-end functions through a line of sight on customers’ digital behaviors. Mascoma now can see where a customer has abandoned an application, making it easier to reach out to them and find out what went wrong. For example, if the bank is losing new customers during the identity verification process, Reznek said the bank can have an internal conversation about how to change those requirements without increasing fraud risk.

Mascoma’s digital platform launch comes at a time when the bank is rebranding itself. Mascoma recently opened a new branch in Burlington, Vermont, a college town with a younger customer base than some of the bank’s rural branches. It’s also taking a page from Capital One, which has tried using cafes to make the branch experience more pleasant. Meanwhile, instead of teller lines, Mascoma added couches to its Burlington branch to allow for consultations. In turn, bankers present product offerings on tablets.

The bank, which has $1.8 billion in assets, spent about three months testing and developing the new application process. As for future plans, Mascoma is looking to continue its upgrades through a new online loan application that has yet to be launched.

To market the digital platform, the bank is relying on social media ads instead of traditional means like television and radio. In a statement, the bank said it opened more new accounts in three days after the launch than it opened through the app in the previous year and a half. Reznek didn’t say how many accounts have been opened in total or how many accounts the bank typically opens in a month.

Bank Innovation Build, on Nov. 6-7 in Atlanta, helps attendees understand how to “do” innovation better. It is designed to offer best practices, to guide the innovation professional to better results. Register here.