Dobot’s Zurcher on ‘painting within the lines’ at Fifth Third Bank

While bankers often leave their ivory towers to work at startups, startup product leaders who move to banks have a different type of culture shock to manage.

Andy Zurcher has lived in two different worlds over the past three years. He led automatic savings app Dobot as senior vice president of product since its launch in 2016. Once the company ran out of capital, Fifth Third Bank acquired it in early 2018 and he now runs the bank’s Dobot team out of Denver.

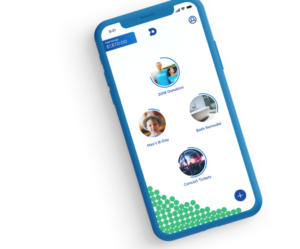

Reminiscent of Digit, Dobot users tell the app what they are saving for and how much they want to save, and the platform analyzes the user’s spending habits to determine amounts of money that can be safely tucked away into a savings account. The app is open to anyone, not just Fifth Third customers, and is now a driver of customer acquisition for the bank.

Zurcher spoke with Bank Innovation about the transition from working at a startup to a large bank. An edited version of that conversation follows.

You went from working for a small startup to working for a big bank pretty abruptly. How did that go?

There’s a thousand ways things are new and different, some exciting and some a little bit frustrating. We still maintain our agility and ability to operate as a team and move quickly, but with the resources of a large bank behind us. The more difficult things have been getting used to working for a large organization where, by definition, there’s more process and adherence to regulatory and IT governance, as well as compliance-type issues. It’s been fun to learn about and it doesn’t take that much longer, but it’s a new part of the process.

The Dobot team works out of Denver, but Fifth Third is headquartered in Cincinnati. How has your workflow had to change since joining Fifth Third?

I’m a big proponent of video conferencing so you can see the room and see the facial expressions of the people you’re talking to. That helps bridge the physical gap.

We share with the IT governance and compliance teams our roadmap every couple weeks: Here’s what we’re working on, here’s why we’re working on it and here’s what some of these screens might look like. It’s to make sure we’re painting within the lines of the bank, which is a new process. However, our product development process remains pretty close to what it was when we were not affiliated with the bank. We’ve just put some borders around us to make sure we don’t cross the line.

See also: Fifth Third Bank has applied for a national bank charter

There are a lot of savings apps. How is Dobot going to differentiate?

We’re free, and that carries a lot of weight. We’re not charging you to save your own money. We designed the app in a way that is engaging. You can send Dobot a text that will say, “Tell me a joke”, and we’ll respond with a joke. The way we message and engage with our users is the way you would engage with a trusted friend, but obviously we keep it professional.

Next week, we’re launching a new feature that we call ‘Scheduled Savings.’ Maybe you want to save $5 every Monday, Wednesday and Friday, or maybe you want to save every payday. It’s up to you.

How much do you think about customer acquisition when working on Dobot?

It’s not a bait and switch. However, if we know that you’re saving for a down payment on a home or you’re saving for a kitchen remodel, that’s really good information. We at the bank can figure out how we want to make you aware that we have these types of offerings and how you can finance these projects. If you have a great experience with a product that’s offered by Fifth Third Bank, then you’re likely increasing the consideration of Fifth Third Bank. So right now, it’s been soft on directly trying to pull people to becoming customers of the bank, but there’s significant opportunity down the road.