BofA’s AI-powered assistant Erica pulls in 10 million users

Half a year after Bank of America’s AI-powered digital assistant Erica reached 7 million users, Erica has surpassed 10 million users, Bank of America reported this week. The virtual financial assistant is on pace to complete 100 million client requests in the coming weeks, according to the bank.

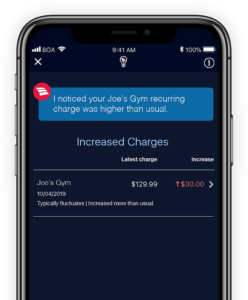

Christian Kitchell, AI solutions and Erica executive at Bank of America, said the jump from 7 to 10 million users was caused by steady customer adoption after the bank launched proactive insights in November 2018. The insights provide customers with recommendations and guidance based on their behaviors to help them manage their money.

“Within a month of launching insights [last year], we saw a better than two times jump in engagement, and we’ve sustained that through the path of last year,” he explained. “It’s a function of more clients starting to recognize the appeal and value that we bring — because we’ve been enhancing Erica quite a bit through our development cycle.”

With Erica, Bank of America developed a digital banking experience that encompassed voice, in-app messaging and predictive analytics.

When Erica was launched in 2018, Bank of America joined other large banks with its rollout of AI-powered tools, including Capital One’s Eno and RBC‘s NOMI. Beyond just assisting customers with day-to-day tasks, however, Erica also serves as a vehicle to help the bank get insights on the uptake of new products and services.

See also: BofA’s AI-powered assistant crosses 7 million users

Several new enhancements will be launched through Erica in 2020, including a “New Card Merchant List Assistance” feature that allows Erica to provide clients with a list of merchants and subscription services where their card information is stored. Clients will also be able to ask Erica for a list of companies that have their card information on file. In addition, the bank will be launching a “Duplicate Merchant Charges Insight” feature, which includes advice on how to dispute a charge.

“Now that we’ve built a very strong foundation in terms of Erica’s core services and capabilities, we will be focusing more on the insights development piece, which is great because it’s been amazingly successful and popular with clients,” Kitchell said.

Through an analysis of customer data throughout 2019, Bank of America learned that though user numbers increased, demographics have been consistent. When Erica reached 7 million users this June, 49% of users were millennials, 20% were Generation X, 16% were Baby Boomers or seniors and 15% were Generation Z, according to the bank.

While customers may be enthusiastic about chat features, they appear less interested in voice. In June, the bank reported that voice-based communication made up only 13% of interactions with Erica, compared to 40% of interactions that were carried out via in-app chat. Kitchell said this figure was still accurate, but he is hopeful that more users will adopt voice-based tools as institutions grow use cases.

“We are still really early in the game on voice,” he said. “We’re in the first mile of a marathon, and we think that the voice usage will continue to grow over time.”

Bob Meara, senior analyst at Celent, previously told Bank Innovation that BofA’s investments in Erica set a high bar among legacy institutions. Calling BofA’s moves “gutsy,” he said Erica represents a new business model for a legacy institutions, one where revenue from longer-term relationships trumps fees.

“Many banks have been addicted to [fee] income for decades, so for a big bank to proactively seek to reduce it in the name of improving customer experience and adding value, I think that’s laudable,” he told Bank Innovation.

Bank Innovation Ignite, which will take place on March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations. Request your invitation.