RBC’s ‘Ask NOMI’ answers 1M questions

As Royal Bank of Canada continues to tweak its mobile app, customers can now verify their identities by scanning photos of their government IDs and also pose questions to NOMI, the bank’s digital assistant. According to RBC, the bank has already seen more than 200,000 unique users receive answers to more than 1 million questions since launching the tool, called “Ask NOMI,” in mid-March.

“Our clients have a multitude of relationships with us,” said Rami Thabet, vice president of digital products at RBC. “We’ve talked to our clients and done research, and we’ve found that they are not seeking multiple apps to meet their needs. They would like to engage with RBC in one way digitally, but they would also like these insights and these unique perspectives that we have.”

Toronto-based RBC, which has CA$1.52 trillion in assets ($1.08 trillion), has spent much of the past year creating personalized app experiences for customers, including an edition for young students, an investment edition and AI insights for business owners. With the digital ID-verification tool and new question function, the bank aims to up its engagement with customers through digital channels.

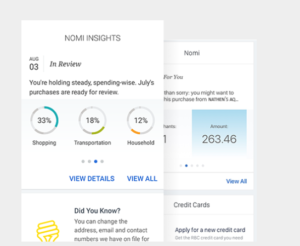

RBC launched NOMI in 2017 as a way for customers to view their spending patterns through a tool called “Insights,” and to automatically save extra cash through the “Find & Save” tool. The bank launched “NOMI Budgets” last year to help customers control their finances, developing the technology through the conversational AI company Personetics, which also works with U.S. Bank and Ally. Thabet said the bank builds its own functions on top of Personetics’ technology.

With the Ask NOMI tool, which works in 12 languages, customers can ask questions about their spending — for example how much they’ve spent on coffee in the past month — through in-app texts or voice.

See also: RBC to launch retail bank for US customers

The ID-verification solution, also launched in March, allows customers to scan and upload photos of government-issued driver’s licenses or passports. Customers with newer passports from Canada, the U.S. and the E.U. can simply tap the chip in their passports, using near-field communication to verify their identity. The technology works through mobile and at bank branches, and customers can use it for new financial products or just to service their accounts. Prospective customers looking to create a new relationship with RBC can also use the solution.

According to RBC, it is the first bank in Canada to launch a digital identity verification tool. Thabet said RBC verifies the legitimacy of customers’ IDs through unique characteristics like watermarks, font type and barcodes. Although he said the bank developed the technology through partnerships with third parties, he didn’t disclose the vendors the bank used.

Eran Livneh, who served as VP of marketing at Personetics from 2015 to 2019, previously told Bank Innovation that banks understand their need to help customers better manage their finances. “They understand that launching [additional apps for money management] is not the right way to do it; it needs to be integrated with what people are doing day to day,” he said.