With point-of-sale loans, PayPal eyes millennial and Gen Z shoppers

As retailers seek to increase customer purchase volumes through point-of-sale loans, PayPal is setting itself apart from competition through its brand recognition, the speed of its underwriting process and its relationships with hundreds of millions of consumers.

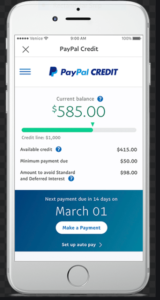

It’s promoting its point-of-sale loan product, PayPal Credit, as a purchase driver for retailers.

“When [millennials and Gen Z] customers engage in personal finance, they demand frictionless, seamless experiences, and that’s really what PayPal has built our entire business on,” said Susan Schmidt, PayPal’s vice president of U.S. consumer credit, speaking at the National Retail Federation’s Big Show in New York on Sunday. “When you put PayPal credit up [on an e-commerce platform], those customers have billions of dollars of approved credit that they can use to shop on your sites.”

PayPal’s point-of-sale loan product offers no-interest financing on purchases above $99, provided customers pay back the balance in six months. Meanwhile, for purchases under $99, customers need to pay the balance in full each month to avoid interest charges.

While PayPal sees checkout loans as an opportunity, the field of companies competing for business in this area is becoming increasingly crowded. PayPal’s point-of-sale loans, which are offered in partnership with Synchrony Bank, compete with offerings from Affirm, Klarna, Afterpay and Splitit. Despite these pressures, Schmidt said PayPal’s advantages include its reputation among consumers and the simplicity of the loan approval process, which can take seconds.

See also: Affirm rolls out virtual card for checkout loans

According to Leslie Parrish, senior analyst at Aite Group, the market for point-of-sale loans can accommodate multiple players.

The point-of-sale loan pie is also progressively getting bigger. A November 2019 report from McKinsey & Company claimed that the total U.S. outstanding balances originated through point-of-sale installment lending solutions stood at $94 billion in 2018. Over time, those balances are expected to account for around 10% of all unsecured lending.

Schmidt claimed that having PayPal as a payment method on an e-commerce site means more than half of users are more likely to make a purchase. With PayPal credit, customers’ order volumes are likely to increase, she added, noting that among millennials who use PayPal Credit, average order values rise 40% and with Gen Z shoppers, average order values jump by 72%.

With a low barrier to entry, PayPal could be carving out a niche by focusing on everyday purchases.

“It’s differentiated in that they are going so far down the scale of purchase amount, because a lot of players like Affirm are allowing [point-of-sale loans] to be used for much larger purchases, including mattresses or Peloton machines,” noted Parrish.

The consequence of increased interest in point-of-sale loans could be reduced demand for credit cards, concluded Parrish.

“This could ultimately end up shrinking the demand for credit cards, particularly credit cards that are offered through retailers — they could be the losers,” she said.