Shopify launches starter loans for merchants as low as $200

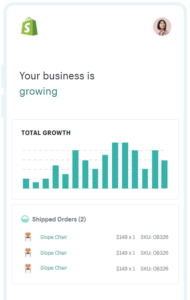

Commerce platform Shopify, which supports the operations of more than 1 million merchants, has launched a loan product for early-stage U.S. businesses.

Shopify, which has been offering loans through the Shopify Capital program to merchants on its platform since 2016, is rolling out starter loans to support businesses at their earliest stages of development, said Kaz Nejatian, vice president and general manager of Shopify Financial Solutions.

Nejatian said minimum loan amounts were previously at least a few hundred dollars, but the important selling point is the simplicity and speed of the qualification process.

“Open up a store, link your bank account and you qualify after the first month for your loan. You don’t need to have a business plan, you don’t have to have any sales information and you don’t need to give a personal guarantee or your income,” said Nejatian. “The idea here is to make it a little bit easier to buy your first marketing campaign, or buy your first inventory.”

Shopify Capital loans are available to merchants who use Shopify Payments, the platform’s payment gateway which, according to a company spokesperson, includes most Shopify merchants. Since its establishment, Shopify Capital has delivered more than $750 million in loans, which are available in 14 states.

See also: Why SellersFunding sees an opportunity with Amazon, eBay merchants

With its loan products, Shopify joins a field of commerce platforms lending to businesses that use their products and services, including Amazon, eBay, Square and PayPal. Meanwhile, digital lenders including OnDeck, Kabbage, Bluevine and SellersFunding also seek to reach business customers who would otherwise be ignored by large banks. By reaching clients at an early stage, Shopify can deepen its relationships with client businesses.

“[Alternative lenders] have better data than a bank would have and can offer loans to sellers who would have no access to funding,” Juozas Kaziukėnas, CEO of e-commerce research firm Marketplace Pulse, recently told Bank Innovation. “It’s the issue of being too small for a bank and, even if they talk to you, you don’t have enough history of business execution to be a bank client.”

Since Shopify has access to an extensive trove of customer data through client interactions, it’s able to underwrite businesses that would otherwise be turned away by large banks, noted Nejatian. Repayment terms depend on each client’s circumstances, but clients repay Shopify through a fixed percentage of sales for the life of the loan.

“I think you would have a very hard time going to bank and saying ‘Let’s loan $200 to people with no personal guarantee, no business plan, and no sales [information],'” he said. “They would look at this and say, ‘that’s a terrible idea.’ We look at this and say this will launch the next million small businesses around the world.”

Bank Innovation Ignite, which will take place March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations. Request your invitation.