Stock trading app Invstr adds mobile classes to attract more clients

Stock trading app Invstr is rolling out a series of educational tools to make investing accessible to a wider audience.

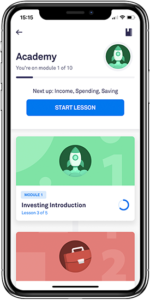

The mobile-based training program is called Invstr Academy, which launched last week. It’s a move by the company to expand beyond its learning-by-doing model where users can invest with fake cash, and it beefs up Invstr’s subscription offering. Invstr charges subscribers $3.99 per month, and the first two learning modules will be available to free users.

“Even if brokerage is free on some of our competitors’ apps, most people can’t enjoy it because they don’t know what to do,” said Kerim Derhalli, CEO of Invstr. “If you put free champagne and caviar at the North Pole, nobody is going to enjoy it because people can’t get to the North Pole.”

Invstr is aiming for users who want to invest but feel too intimidated by the complexity of jargon and rules. Compared to do-it-yourself models pursued by some competitors, Invstr feels its educational aspects make it a more approachable option.

As Invstr rolls out its mobile training modules, it’s not giving up on its gamified approach. According to Derhalli, that’s because some customers prefer hands-on learning like Invstr’s Fantasy Finance option where users can invest with fake cash.

Invstr Academy features 85 lessons spread over 10 modules, and the lessons focus on topics like financial markets, main asset classes and some of the big names in investing. At the end of each module, users take a quiz to unlock the following module. When users have completed all the modules, they are prompted through a link to start investing for real through Invstr.

Invstr Academy builds on the app’s Fantasy Finance option, which allows users to invest $1 million in fake money. The investments fluctuate with the real markets, so users learn how to make investment decisions without any real risk. Invstr also features a social aspect, as users can follow one another to see what stocks friends have been buying and selling.

See also: Game on: Investment app Invstr uses Fantasy Finance to build young user base

Since Invstr was founded in 2013, 500,000 users have joined. The premium option also features double the number of trades and technical analysis charts. The company markets through social media channels, and the company plans to begin a referral program that rewards both the inviter and the invitee. Derhalli himself has more than 30 years of banking experience at big names like JPMorgan Chase, Lehman Brothers, Merrill Lynch and Deutsche Bank. The London-based company has about 25 employees.

Despite the allure of the training programs, Invstr faces competition from other investing apps, including Stash, Acorns and Robinhood, which have also added educational elements to their product offerings. Vijay Raghavan, senior analyst of digital business strategy at Forrester Research, said the mixture of gamification, online lessons and social networking is Invstr’s play to reach the same younger demographic targeted by apps like Robinhood.

The real value of Invstr, he said, might show during a recession, when customers require additional support. “Investing by nature is complicated, and I expect interest in platforms like Invstr to increase during the next economic downturn after more first-time investors suffer economic losses because they didn’t really know what they were doing,” he said.

Bank Innovation Ignite, which will take place on March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations. Request your invitation.