US Bank launches API portal for third-party developers

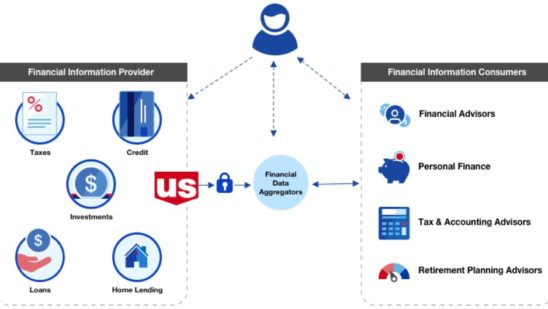

U.S. Bank launched a suite of API tools this week to support third-party app developers in their efforts to build services that can securely connect to U.S. Bank account information.

In an apparent shift from the traditional, walled-garden approach of large banks, U.S. Bank’s developer portal enables developers to build apps that may compete with offerings of the bank. Despite this risk, it’s a move that keeps pace with customer expectations, Gareth Gaston, executive vice president of omnichannel at U.S. Bank, told Bank Innovation. The APIs include accounts; a data toolbox incorporating account insights; documents; a transactions API; and the bank’s Voyageur API for fleet expenses.

“There’s a plethora of amazing innovations out there, and our goal is to support them because our customers want to use them,” said Gaston.

API-based secure connections allow third-party applications to securely fetch account data without the need to “screen scrape,” a practice in which a third-party app logs into a customer’s bank account on their behalf and “scrapes” the data into the third-party platform. It’s the reason why Wells Fargo last week enabled API-based connections to third-party apps through a data-sharing agreement with Plaid.

See also: With Plaid, Wells Fargo gives customers a new lever to control their data

U.S. Bank’s developer portal rollout comes on the heels of agreements announced this week with seven partner companies to enhance access to account information and developer tools. Partners include data aggregators and fintech companies, five of which it named. They include DecisionLogic, a company that focuses on bank verification solutions to qualify potential borrowers; financial planning platform eMoney Advisor; document aggregation platform FileThis; data aggregator Finicity; and data platform MX.

For now, the portal is available to companies who apply to access U.S. Bank’s products and services. The bank currently doesn’t intend to generate revenue from it, but it is considering potential future revenue streams, according to Gaston. In addition, the bank intends to continue to grow its suite of capacities, including plans to roll out capabilities for its customers to acquire a 360-degree view of how their account data is being shared. It didn’t specify when this feature would be launched.

U.S. Bank’s developer platform and enhanced data-sharing efforts are in line with where the industry is moving, according to Celent senior analyst Stephen Greer. “It means facilitating fintechs to innovate or do things akin to platform banking or banking-as-a-service, and that’s where you get into interesting opportunities [for the bank],” he said.

For U.S. Bank, supporting other companies in their efforts to innovate is a new way to extend the bank’s brand. “The financial ecosystem is going to exist, and our customers are going to do what they want to do,” said Gaston. “It’s far more important to embrace the opportunity for the customer that’s out there and help the customer have the experience they want to have.”