Military-focused banks combine high touch with high tech

The COVID-19 pandemic has forced many banks to grapple with how customers can manage their finances outside brick-and-mortar bank branches, but military-focused institutions like USAA, Navy Federal, Armed Forces Bank and PenFed have been dealing with this for years. The head start seems to have helped USAA and Navy Federal, which have taken the top spots for direct and multichannel banking, respectively, in Forrester’s US Banking Customer Experience Index report for five years running.

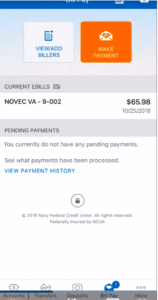

“There’s this fluidity of life in the military where you have to move quickly,” said Timothy Day, vice president of digital channels at Navy Federal Credit Union. The $129 billion-asset credit union is open to military personnel and their families. “You might be one place one week and then get orders that you’re shipping out the following week.”

The 1.3 million active duty personnel and 18.2 million veterans in the U.S. face circumstances that lead to practical concerns, like managing finances from a place devoid of bank branches or even cell service, for one. Not only are service members asked to deploy overseas, go to the field and move across the country, but they often receive special benefits like variable housing allowances, relocation stipends and disability pay. Families must also navigate the complexities of veterans’ benefits, like the Post-9/11 GI Bill and retirement pay.

According to Day, the Vienna, Va.-based Navy Federal uses simple financial language in its digital channels and offers chat functions and searchable FAQs, in addition to traditional branches and call centers. The credit union also uses the loan application vendor Blend for its HomeSquad mortgage application, which digitizes the process, allowing members to upload documents like pay stubs and tax returns from anywhere. According to a Forrester case study on Navy Federal, the credit union fosters understanding of its unique customer base by hiring from the military, requiring executives to listen in at the call center, and focusing on quality of the outcome, ignoring metrics like how quickly a rep finishes a call.

New solutions at Navy Federal often start with a customer journey map to understand where pain points arise. According to Day, the credit union uses data from branch visits and the contact center to identify where members hit digital banking roadblocks. The credit union also gathers feedback from its members through surveys and interviews, and puts unfinished products, such as web journey wireframes or demos, in front of members for feedback.

Armed Forces Bank, based in Fort Leavenworth, Kan., offers members automatic bill pay, facial recognition login and the ability to load cash onto debit cards at Walmart. According to CEO Paul Holewinski, the bank has about 100,000 accounts, and some customers have multiple relationships with the bank. The bank is currently piloting a new mobile loan product that allows customers to apply and receive funding remotely, and it should launch in the fourth quarter.

Armed Forces is the sister bank of the Kansas City-based Academy Bank and Holewinski serves as CEO of both. He said that while Academy offers video chat functions, Armed Forces focuses on the text-based chat that is more popular among military personnel; Academy’s video bankers double as chat servicers for Armed Forces. According to Holewinski, Armed Forces is developing a chatbot with a vendor company, which he declined to name, that should launch in the fourth quarter.

“We’re on 23 [military] installations in 15 states,” Holewinski said. “We really try to combine high-touch service with high-tech solutions.”

According to Alyson Clarke, Navy Federal and USAA prioritize data-driven decisions around their military customers.

See also: Banks face hard decisions about business models, Forrester’s Clarke says [Industry Pulse]

“Whenever I talk to anyone from Navy Federal or USAA, it’s almost as if they don’t breathe without thinking, ‘How does this add value to the customer?’” Clarke said. “Most banks don’t breathe unless they know how it’s going to add value to the bank.” Although other banks could argue military-focused institutions have a leg up with customer experience because they focus on a specific demographic, she pointed out this is essentially an admission from other banks that they don’t really know their own customers well.

Not all consumers who use a military-focused institution are in the military themselves. Family of service members often use USAA and Navy Federal, while Pentagon Federal Credit Union offers membership to nonmilitary personnel. For these institutions, however, designing for a customer segment with unique needs can have overarching benefits. Serving military personnel “has definitely helped PenFed become a more agile institution that is more responsive to the financial needs of all our members,” said Ricardo Chamorro, PenFed’s executive vice president of consumer banking and strategy.

The 2020 Banking Automation Summit Virtual Experience, taking place November 9-10, is a new event that will provide a platform for industry professionals to share fresh insights, tools, trends and strategies. The Summit will focus on how automation will transform banking, especially with regard to back-office operations, risk management, data science and utilization, customer experience and more.