Digital and human: Inside BofA’s small business strategy

Digital-only lenders tout the speed and efficiency of their user experiences. However, for Bank of America, a “human-digital” approach is the cornerstone of its small business banking efforts.

It’s a strategy that’s yielding results for the bank. As of this year, Bank of America said it surpassed Wells Fargo as the nation’s top small business lender. As of the second quarter, it had a loan balance of $38 billion in commercial loans under $1 million.

To Sharon Miller, head of small business at Bank of America, continued growth among its small business clients means improving digital offerings. The bank differentiates from online-only players through staff members who are small business specialists, resources it eventually intends to deploy to all 4,300 of its branches. Looking ahead, the bank wants to be the financial pillar of all of its small business banking customers’ needs, folding all of their business and personal financial accounts into one place.

“We don’t say ‘apply today [for a loan], get approved tonight’ — that’s not how we do business,” said Miller. “We want to know the business, we want to know the company and that’s how we’re able to provide the right loan at the right pricing at the right time.”

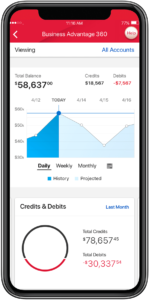

Meeting customer expectations means being more than a neighborhood resource for business owners. It means continually evolving digital capabilities. To this end, earlier this year, the bank rolled out cash management tool Business Advantage 360, a digital platform accessible through desktop and mobile interfaces that offers real-time cash flow updates and projections. According to Miller, the platform’s next iterations will include the ability to aggregate data from external accounts.

Looking ahead, the bank is working on improving its underwriting tools. “We’re implementing a new platform for our underwriters and fulfillment for our sales force,” Miller said. “The goal is to be the fastest in the industry.”

See also: Bank of America revising new app to bolster small business client base

Capacity to underwrite customers is one area where Bank of America is taking inspiration from fintech startups, including easy user experiences and faster processing times. “[Fintech startups] have very good underwriting systems and back office [systems]; those are the efficiencies that we want to mimic,” Miller said. In doing so, the bank will continue to emphasize the importance of its staff members, who can unpack more complicated questions for clients.

Miller outlined two challenges the bank is addressing among its small business clientele: improving digital adoption and making the case that it can serve a range of financial needs beyond those that pertain to their business objectives. While 27% of its consumer product sales are initiated through digital channels, only 10% of its business product sales come through digital. “We have that 3.4 million small business clients and others who are consumer clients that have a business,” Miller noted. “We’ve got to make sure that we are out there telling the story of how we can manage their whole [financial] life.”

In examining the bank’s customer segments, Miller noted that enhancing access to resources for women entrepreneurs is a priority. According to a survey of women entrepreneurs carried out by the bank, 84% felt that access to capital has improved for women over the past decade. However, respondents noted that, on average, it will take 14.4 years to achieve equal access to capital on par with male counterparts. To this end, the bank has invested in educational resources and partnerships, including the launch of an online Institute for Women’s Entrepreneurship, in collaboration with Cornell University in September 2018, and a $1.6 billion investment in Community Development Financial Institutions.

“We’re focused on providing access to capital and how to get there — the training and education for business owners,” said Miller. “Don’t wait until you need a loan; let’s talk about what’s happening in your business, so we can be a partner.”

Bank Innovation Build, on Nov. 6-7 in Atlanta, helps attendees understand how to “do” innovation better. It is designed to offer best practices, to guide the innovation professional to better results. Register here.