Startup Branch wants to build a money services platform for hourly workers

With the growth of digital finance tools, a group of startups is looking to reach those who may be left behind, namely hourly workers. Among them, Minneapolis-based Branch is working with employers to offer such employees digital money management tools and a portion of a worker’s paycheck in advance. It’s also considering other products like credit and savings.

The challenge that Branch’s target customers face, as compared to salaried workers, is unpredictable income flows due to inconsistent hours, Atif Siddiqi, co-founder and CEO, told Bank Innovation. “These employees are underserved by traditional financial institutions or even unbanked,” he said. “The alternative to a service like Branch is a payday loan or late fees. We’re providing them with a viable alternative that’s fair and transparent.”

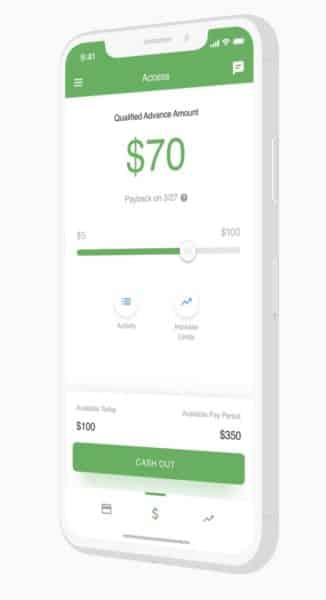

Workers that seek a portion of their wages early can use Branch’s product to make this happen. The company currently offers two ways customers can access these funds early: through a free ACH transfer that takes three business days or via instant transfer through a partnership with Mastercard and Evolve Bank & Trust announced on Wednesday. There is a $3.99 fee per transaction for an instant transfer.

The growing field of companies offering payday advance services that compete with payday lenders can be seen as a win for the consumer. Branch generates revenue through subscription fees employers pay and through instant transfer fees users incur. In response to a concern that early access to pay can encourage poor financial choices, Siddiqi said customers with unpredictable earnings often have no choice but to incur overdraft fees or take out costly payday loans.

Apart from Branch, startup Even works with retailers such as Walmart, Instant Financial has partnered with Wendy’s to offer employee payday advances and Earnin lets employers access a portion of their earnings early without a relationship with the employer. According to Siddiqi, Branch differentiates itself by embedding its app within employers’ pay and HR platforms. “The relationship with the employer has been really key for us, [and] we can provide a great experience to a new employee when they join the company,” he said.

The company is tight-lipped about which companies are its partners, but Siddiqi confirmed that Branch currently works with Pizza Hut and Taco Bell. Its choice of headquarters in Minneapolis also offers some insight as the Twin Cities area is home to Target’s Techstars Retail Accelerator, a development program Branch completed in 2016.

Siddiqi would not comment on whether Target is a current Branch partner. “We were working with some large retailers based [in Minneapolis],” he said. “A lot of our early customers were enterprise customers, including a large swath of hourly workers in various industries such as logistics and distribution centers.”

For Mastercard, instant payment partnerships with companies like Branch and Lyft are part of a bigger effort to advance financial inclusion. “For us, it’s about inclusive growth, leveraging our technology for use cases that make people have better lives,” said Jess Turner, Mastercard’s North America executive vice president of product and innovation.