Retail rewards as in-app cash: Venmo embeds with loyalty programs

Brands have begun to Venmo their most loyal customers with rewards points converted to Venmo cash.

PayPal-owned Venmo this week rolled out a partnership with PepsiCo’s loyalty program Pepcoin, in which customers who buy a PepsiCo beverage and a Frito-Lay snack together can earn up to 10% in cashback rewards, paid out in Venmo cash after the customer scans the product bar codes. It’s PayPal’s latest effort to grow adoption and maximize reach for Venmo through retail and brand partnerships. It’s also the most recent initiative to dole out rewards through the Venmo platform, after Chipotle rolled out a similar program on a limited-time basis in March.

According to a PayPal spokeswoman, the brand’s decision to roll out rewards via Venmo was based on customers’ desire to receive rewards as quickly as possible and for the flexibility to spend rewards currency however they want. “As more and more people rely on Venmo and PayPal for everyday purchases, it made perfect sense to connect our brands, so PepsiCo customers can earn digital cash back and use their rewards to shop more places with Venmo and PayPal,” she told Bank Innovation in an statement.

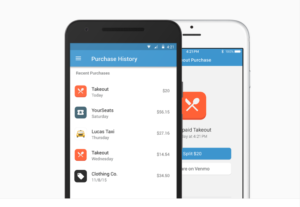

For PayPal, sending rewards currency as Venmo cash serves two objectives: to help grow Venmo’s users numbers and user engagement on the platform and to encourage users to spend Venmo cash directly at retail stores with which it partners. Over the past two years, the company has been working with retailers to add Venmo as a payment option, which is marketed to them as a purchase driver. According to the company, millions of e-commerce merchants accept Venmo as a form of payment, including such known brands as Uber, Forever 21, Fandango and Foot Locker. Retailer partnerships are seen as a key driver for Venmo monetization.

For brands, aligning with Venmo helps them reach a customer base that’s actively using the peer-to-peer payments platform. According to PayPal, Venmo has 40 million users. “PepsiCo is trying to appeal to millennials and Gen Z by rewarding them where they are — on Venmo,” said Talie Baker, senior analyst at Aite Group. “[Venmo] gets more brand recognition, and it might help drive adoption.”

According to PayPal, PepsiCo is funding the cashback rewards for its loyalty program. Cashback rewards, with their high perceived value, are a useful engagement driver, but the challenge is to draw return on investment for the high cost of customer acquisition, noted Sean Edison, loyalty lead at T3, a digital marketing agency that works with brands and retailers. “Credit cards have been buying loyalty currency for a very long time as a way to drive user acquisition and engagement,” he said. “They’re borrowing that tactic from credit cards and applying it to peer-to-peer payments technology. This 10% rewards ratio — no matter who’s funding it — is pretty expensive.”

Last month, PayPal reported Venmo’s total payment volume hit $24 billion during the second quarter, a 70% year-over-year increase.

Bank Innovation Build, on Nov. 6-7 in Atlanta, helps attendees understand how to “do” innovation better. It is designed to offer best practices, to guide the innovation professional to better results. Register here and save with early bird rates ending September 27th.