London’s fintech boom opens the door for dirty money

A 10-minute walk from the Bank of England, on the eastern edge of the City of London, lies a gateway to a new shadow world of money.

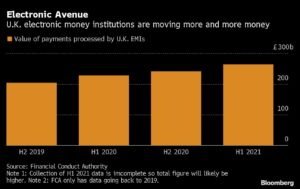

Here on Dukes Place is the office of Moorwand Ltd., one of a fast-growing breed of upstarts that bill themselves as alternatives to old-fashioned banks when moving money around the world. Each day in the U.K. alone, an estimated 1.4 billion pounds ($1.9 billion) courses through loosely regulated digital payments businesses like Moorwand. Though only a small fraction of Britain’s financial flows, it’s a system critics warn is opening a door for dirty money.

Moorwand is one of more than 200 electronic money institutions, or EMIs, approved by U.K. regulators since 2018. Trouble soon followed: A tiny lender in Denmark with which Moorwand had developed a close relationship flagged hundreds of suspicious transactions involving the payments firm, according to internal bank documents seen by Bloomberg News. In 2018, Danish authorities seized the bank, Kobenhavns Andelskasse, citing violations of money-laundering laws and referred the matter to the police.

Moorwand, controlled by Moldova-based businessman Wael Sulaiman Almaree, hasn’t been accused of wrongdoing and is still authorized to move client funds. Neither Almaree nor Moorwand responded to repeated requests for comment.

Now questions are swirling around dozens of EMIs regulators licensed as part of a move to boost London’s reputation as a fintech center and promote banking competition. Hundreds of regulatory, legal and corporate filings reviewed by Bloomberg sketch an unsettling picture of this new corner of the City. And they point to oversight weaknesses at the U.K.’s Financial Conduct Authority.

Among the companies approved by the FCA, Bloomberg’s review found, are ones with executives or shareholders tied to Baltic money-laundering scandals, alleged financial wrongdoing in Russia and Kyrgyzstan, health-care fraud in the U.S. and suspected wrongdoing in Luxembourg and Australia. Dozens of firms are controlled by investors in jurisdictions far beyond the U.K., including the British Virgin Islands, Cyprus, Ukraine and the United Arab Emirates. Some openly boast of doing business with high-risk customers.

Transparency International U.K., the British arm of the global anti-corruption group, sounded an alarm in a report last month saying more than one-third of EMIs licensed by the FCA have red flags related to their activities, owners or directors.

“It’s a Wild West even without the added complication of those moving into the area with deliberate criminal intent,” said Graham Barrow, a financial-crime analyst who has worked for lenders including HSBC Holdings Plc, Nordea Bank Abp and Societe Generale SA. “What you have is a free-for-all, and the regulators are desperately fighting to catch up with it.”

FCA data show the agency has taken some action. It rejected 50 of the 89 applications received last year and recently conducted eight formal reviews of EMIs. The regulator previously imposed business restrictions on four firms.

“We are focused on tackling financial crime,” an FCA spokesperson said in an email, declining to comment about Moorwand or other companies. “We have done a substantial amount of work to raise anti-financial crime standards at payment and e-money firms, including placing business restrictions on some. We will continue to take assertive action where firms do not meet the standard we expect.”

EMIs emerged about a decade ago. They offer payments services such as processing transactions, prepaid cards, overseas remittances and digital wallets. But they often serve high-risk clients who traditional lenders would refuse to deal with, such as those trading cryptocurrencies, said Jon Wedge, a partner at London accounting firm Berg Kaprow Lewis LLP.

“These guys can’t get banking services,” said Wedge, who works with payments businesses. “What they [EMIs] do now is they fill a gap in the market that’s not filled by High Street banks or main acquiring banks.”

Money laundering already costs the U.K. more than 100 billion pounds a year, according to government estimates, and the proliferation of EMIs without tighter regulation could worsen London’s reputation as a dirty-money hub, Wedge and others say. Concerns are even more pressing in the wake of the collapse of Wirecard AG in Germany last year. That company’s chief regulator, BaFin, missed signs that it was a sham before it imploded with $2.3 billion of funds missing from its accounts.

“If you’re sitting in the seat of someone in the FCA, you’d be worried,” said Alan Brener, a law professor at University College London who has studied the EMI industry. “Is there another Wirecard kicking around in my area of jurisdiction? You’d be doing a skeleton hunt to see if you can find one or more than one.”

Governments across Europe have been trying to shake up the payments business for years and wrest control from global banks to help reduce costs for customers, according to Brener. The European Union’s Payments Services Directive, introduced in 2007 and revised about a decade later, was designed to simplify transactions and encourage new market entrants.

E-money companies are typically subject to lighter regulation than banks. They are allowed to process payments and hold customer funds, but clients aren’t protected by national deposit insurance programs and firms cannot lend.

More established firms, including Revolut Ltd. and Checkout.com, and dozens of smaller ones are part of London’s growing fintech scene, one of the world’s biggest and prized by the U.K. government in the wake of Britain’s exit from the EU. Use of e-money accounts increased fourfold from 2017 to early 2020 to 4% of adults. The Bank of England, which doesn’t regulate e-money firms, says customers have about 10 billion euros ($11.3 billion) parked at the companies.

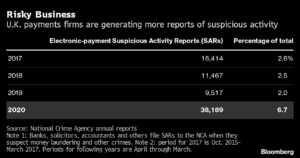

Along with the growth is the potential for greater risk-taking. The number of Suspicious Activity Reports, or SARs, linked to the electronic-payments sector quadrupled in the year through March 2020. A spokesman for the U.K.’s National Crime Agency said the surge in SARs—which firms and individuals are required to file when they’ve observed shady behavior—wasn’t unexpected given the expansion of the industry. The Bank of England has warned that the sector “could in the future present systemic risks.”

Few have embraced the business more than Moorwand’s former chief executive officer, Robert Courtneidge. Renowned for his payments expertise, Courtneidge, 57, has been a qualified solicitor since 1990.

By the mid-2010s, he was a consultant at U.S. law firm Locke Lord LLP, a colorful presence at fintech industry awards in London and beginning to take up EMI board roles. He also did some cryptocurrency consulting for Ruja Ignatova, a Bulgarian known as the Cryptoqueen, who was then promoting the OneCoin digital currency. U.S. prosecutors accused her of overseeing a $4-billion fraud. She never appeared in court to face the charges.

In 2015, Courtneidge became a director of AF Payments Ltd., a London-based firm that received its EMI license several years later. The company’s founder and CEO is fintech entrepreneur Guy Raymond El Khoury, but its only listed shareholder is a British Virgin Islands entity, filings show.

El Khoury previously ran FBME Card Services Ltd., a related company of FBME Bank Ltd. That bank was barred from the U.S. financial system after accusations that it had laundered funds for criminal organizations and paramilitary groups including Hezbollah. El Khoury said through his lawyer that he wasn’t responsible for wrongdoing at the card services company, which didn’t involve money laundering, but rather sought to end it. Neither El Khoury, AF Payments nor Courtneidge have been accused of any misconduct.

Courtneidge joined the board of CFS-ZIPP Ltd., another EMI, in 2016. He allegedly helped arrange a 1.5 million-pound loan from the company and its owner to a currency-trading firm promoted by a then-business partner, according to a U.K. legal action filed last year. That venture, SwissPro Asset Management AG, collapsed in 2019 with losses of more than 50 million pounds. A Swiss regulator said in a letter to creditors that the business “appears a Ponzi scheme.” Courtneidge, who left the CFS-ZIPP board that year, hasn’t been accused of wrongdoing.

He became a director at ePayments Systems Ltd. in 2018, two months after that firm was licensed by the FCA. Founded by Russia-based businessman Mikhail Rymanov and controlled by unidentified offshore shareholders, the company had amassed about 175 million pounds of client funds, U.K. filings show. Yet in February 2020, it announced it had suspended all activities following an FCA probe of its anti-money-laundering controls. Courtneidge left the board several days later and hasn’t been accused of any wrongdoing.

EPayments said on its website last month that it was back in business. Masoud Zabeti, a lawyer at Greenberg Traurig representing the firm, said the company has “developed a robust and industry-leading approach to support the stamping out of fraud and prevention of money laundering.”

Courtneidge declined to comment about his work at ePayments or any other company, but in a statement to Bloomberg News, he said the EMI industry has been “transformed in recent years” in response to heightened scrutiny. “There has been a marked improvement not only in the level of understanding and implementation of the relevant regulations in line with the FCA’s guidance,” he said, “but also a far better practical ability to put that guidance into practice.”

The FCA’s 290-page handbook on payment-services companies outlines a rigorous approval process. An applicant must be able to convince the regulator that its executives are “of good repute” and haven’t been convicted of a crime, investigated by other authorities or been the subject of an adverse finding in civil proceedings. If a successful applicant then raises suspicions, the watchdog has broad enforcement powers, including conducting raids, probing their operations and suspending or revoking licenses.

But having power is one thing—using it is another. The Bank of England warned of possible gaps in oversight of payments companies in 2019 and called for a sweeping review of how the industry is being monitored. And the FCA has come under criticism from lawmakers since the collapse early last year of mini-bond issuer London Capital & Finance Plc, which exposed retail investors to losses of more than $300 million.

That case didn’t involve electronic payments, but a subsequent probe found a sluggish investigative tendency under then-chief Andrew Bailey, now governor of the Bank of England. A spokeswoman for Bailey declined to comment.

A parliamentary committee concluded in June that the FCA must set key milestones to transform its culture. The agency has requested legislation to give it more powers to supervise EMI managers that would bring its authority in line with its oversight of banking executives.

Jane Jee, a compliance lawyer who works with payments companies, said the risks of an FCA audit are low, that the agency lacks staff to conduct investigations and that it is ineffective in fighting financial crime.

“The FCA is between a rock and a hard place,” Jee said. “It does not have enough resources, and it is also under pressure to open up the market.”

Some enforcement actions raise more questions. Take London-based Allied Wallet Ltd., which the FCA forced into liquidation in 2019, just 18 months after granting it an EMI license. In May of that year, the U.S. Federal Trade Commission accused the company and its owner, Ahmad Khawaja, of processing payments for Ponzi schemers and later imposed a $110 million penalty as part of a settlement. In August 2021, Massachusetts prosecutors accused Khawaja and others of orchestrating a $150 million fraud.

Khawaja hardly had a clean record when FCA officials considered his application. He and a U.S. company of the same name paid $13 million in 2010 to resolve federal allegations that they had processed funds illegally for gambling outfits. Khawaja, a fugitive in a separate case, didn’t respond to requests for comment.

The FCA approved Moorwand’s application for a license in April 2018, around the time Almaree was taking control of the company. Almaree, who’s reportedly married to the daughter of onetime Moldovan political heavyweight Dumitru Diacov, has been known to charm clients in the best restaurants in Chisinau, but others have been spooked by his armed entourage, people familiar with the matter say.

Courtneidge became CEO of Moorwand in early 2018 as the company was deepening its relationship with Kobenhavns Andelskasse. Almaree became a shareholder of the cooperative bank, and Courtneidge joined the board.

At the time, the bank was attracting clients from the Marshall Islands to Belize, according to a regulatory probe reviewed by Bloomberg. The Danish financial regulator requested a police investigation in August of that year, noting that the lender’s payments-services business had attracted a “large number of customers who do not otherwise have a natural connection to the cooperative” and that “such transactions are associated with a high risk of money laundering and terrorist financing.”

Weeks later the bank was placed under the administration of Denmark’s financial authorities. Police have since seized accounts holding millions of dollars linked to Almaree and Moorwand, according to reports in Borsen, a Danish newspaper that has investigated the scandal. Denmark’s serious fraud agency confirmed that a probe into Kobenhavns Andelskasse is ongoing but declined to comment further, as did the nation’s financial regulators.

Courtneidge, who left Moorwand in 2020, hasn’t been accused of wrongdoing. Nor have Almaree or Moorwand. Meanwhile, key roles at the firm, including risk and client-onboarding positions, have been moved to Moldova, according to a review of LinkedIn profiles.

Courtneidge remains active in the industry. He was a judge at the U.K.’s Emerging Payments Awards in October, where he mused in a red-carpet interview about the challenges facing electronic-payments companies. “We’ve got a lot more going on,” Courtneidge said. “The regulators are trying to get it right.”

— By Donal Griffin With Jonathan Browning and Morten Buttler (Bloomberg Mercury)