With $12b in AUM, Personal Capital bets on a human-digital approach

For Personal Capital, the path to scale is go broad. The company this month hit a milestone of $12 billion in assets under management, which it sees as evidence its digital and human approach is yielding results.

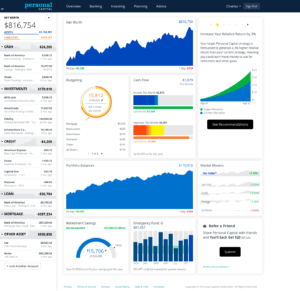

“We give people a 360-degree look at all of their finances — it’s a holistic approach,” Porter Gale, Personal Capital’s chief marketing officer, told Bank Innovation. “We believe that the blend of technology and human advice is a perfect mix, and we use technology to create personalized portfolios.”

The eight-year-old company offers investment products and high-yield savings accounts. Meanwhile, its free digital personal finance dashboard is a powerful customer acquisition vehicle. Two million users rely on Personal Capital’s products, according to the company.

Personal Capital has taken a platform approach alongside robo-advisers that have branched out to banking, including Wealthfront and Betterment. But instead of a digital-only approach, the company said tech is a tool to augment a human-centered experience, with advisers available to assist clients as their needs get more sophisticated.

“What you’re seeing throughout a lot of the industry is many of the other folks started with a pure human or pure robo [approach], and now they’re playing catch-up,” said Dan Stampf, vice president of Personal Capital Cash, the company’s high-yield savings product that launched in June.

Personal Capital is reportedly among the more profitable of digital investment startups. It’s using tailored strategies to attract customers from different ends of the income spectrum. For investors early in their careers, Personal Capital’s free personal financial dashboard and high-yield savings accounts introduce clients to the platform.

See also: ‘If we can’t automate it, we don’t build it’: Wealthfront’s Andy Rachleff on ‘self-driving money’

For experienced and high-net-worth investors, the company’s offerings include a smart withdrawal tool, a feature that helps customers close to retirement plan for their future while considering tax and Social Security implications. In addition, this past year, the company partnered with alternative investment platform iCapital Network, offering high-net-worth customers access to private equity funds and hedge funds. Personal Capital, according to Gale, is garnering increased interest from high-net-worth clients.

According to Dennis Gallant, senior analyst at Aite Group’s wealth management practice, Personal Capital’s growth trajectory has been the result of the breadth of its customer acquisition strategy. While its assets under management fees for its wealth management products run between 0.49% and 0.89% — higher than some larger robo-advisers — its diversified revenue streams give it a leg up over some competitors, he noted.

“Personal Capital has been ahead of the curve,” Gallant said. “With client acquisition, which has been a challenge for many robo-advisers, they’ve been able to build assets and grow.”

Looking to 2020, the company plans to continue to improve its technology stack in an effort to serve clients better. Its product roadmap will evolve to serve clients’ overall financial needs, noted Gale, though she declined to specify which products would be launched.

As Personal Capital seeks to set itself apart from other companies in the digital wealth management sphere, it’s also focusing on brand development.

The appointment of Gale as chief marketing officer in February was a pillar of this strategy. Under her leadership, it launched an advertising campaign, along with a refresh of its logos, messaging and visual branding in October. Personal Capital also hired a new PR agency, Praytell, this month.

“What we found in our research is that people saw us in a very favorable light, but they viewed us as a tools company — we want to bring the human side of the business to the forefront,” said Gale. “We’re seeing increases in all of our down-funnel metrics [since the rebrand effort]; branding, positioning and messaging can help build trust and confidence.”

Personal Capital has raised more than $265 million in funding to date, including a $50 million Series F round led by IGM Financial in February.

Bank Innovation Ignite, which will take place on March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations. Request your invitation.