Digital lenders aim for small businesses underserved by large banks

For small businesses looking to grow, access to capital is critical for success. The obstacle for many of these companies is big banks’ reluctance to approve loan applications from small businesses, particularly since the last recession. According to Biz2Credit, as of May, big bank approvals of small business loan applications sat at just 27.5%.

The gap in the market for small business credit offerings is an opportunity for online lenders. In recent years, it’s fueled the growth of large digital lending startups like Kabbage, OnDeck, PayPal, BlueVine and others. Online lenders approved 57% of loan applications, per Biz2Credit data, indicative of the attractiveness of their offerings to growing businesses.

Banks seeking to grow their small business loan clientele are facing challenges, owing to the barrage of non-banks playing in the space, as Capital One CEO Richard Fairbank recently told investors. “Increasing competition from non-banks continues to drive less favorable terms in the commercial lending marketplace,” he said during an earning call on Thursday.

A simple user experience, speed and real-time monitoring

Online small business lenders offer a product mix and user experience that big banks haven’t been able to crack, including new ways to underwrite risk through real-time monitoring and a broad range of data points, according to David Sica, partner at venture firm Nyca Partners.

“[With banks], there is an archaic process, multiple levels of people and an opaque product with hidden fees,” Sica said. “That’s a ripe area for a fintech company to come in with a solution with a small business in mind. [Fintech lenders] have user-centric design on the consumer side and, on the business side, they’re solving specific problems for businesses.”

Online lenders that spoke to Bank Innovation said what distinguishes them from incumbents is their capabilities to underwrite small businesses by pulling a more comprehensive review of a company’s ongoing transaction flows, tailored product mixes and a decision-making process that can take minutes.

“We utilize a variety of different data sources, and we ask our customers to give us permission access to their online presence, including banking data, their accounting information, their social media presence and other data points,” Deepesh Jain, head of capital markets at Kabbage, recently told Bank Innovation. “We have more than 2 million live connections with our customers, which allows us to monitor the health of our customers.”

A key way to manage ongoing risk, according to Jain, is a line of sight on the financial health of clients through live connections. “If the economy were to turn in the next four years, we have the ability to make sure that we only provide access to responsible customers who we think will pay us back,” he said. Kabbage has lent $7 billion in capital to 185,000 businesses.

See also: Azlo Partners with Kabbage on Small Business Loans to the Underserved

Going niche

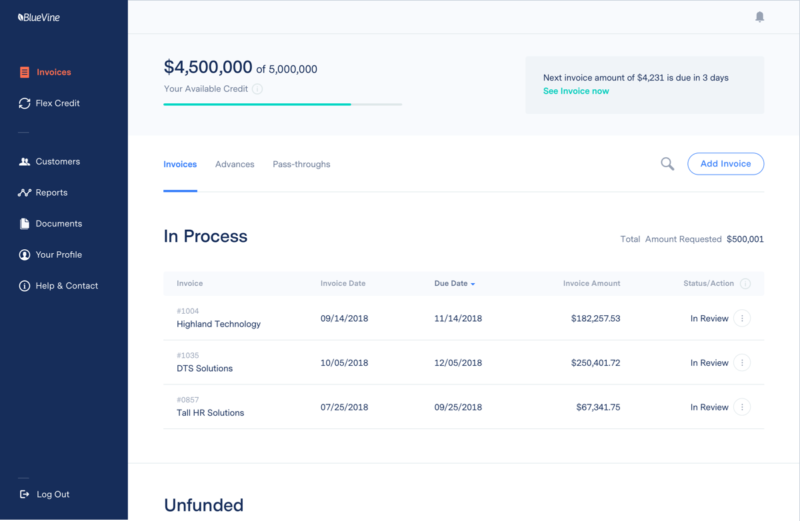

Lending startups also are focusing on distinctive product offerings. Redwood City, California-based BlueVine, a six-year-old company that just hit a milestone of $2 billion in working capital, has lent to more than 15,000 businesses. It offers three products: lines of credit, term loans and invoice factoring. Invoice factoring allows customer invoices to be paid upfront, allowing additional flexibility for businesses with tight cash flows.

“What makes us unique is our ability to provide very sophisticated commercial product or business finance products online, and the second piece is delivering many of them, as most of the companies out there are single-point solutions,” said BlueVine CEO and founder Eyal Lifshitz. “Factoring is a form of commercial financing where we’re really not taking the risk of small businesses; you’re taking large payer risk because factoring is all about purchasing receivables.” The company’s book of payers typically are large Fortune 1000 companies, so the model is resilient to a downturn, he noted.

Fintech companies also are zeroing on specific customer groups. According to Lifshitz, Bluevine’s typical customers have median revenues of between $700,000 and $1 million. This includes, for example, small restaurants and local medical practices.

The specialization of products is likely to continue as more players seek to gain market share, but the model is not without risk. What will set the winners apart, Sica explained, is the ability to weather changing economic conditions. “They’re going to need to properly fine-tune their underwriting engines,” he said. “Over time, managing a balance sheet through different cycles is going to be a key differentiator.”

Bank Innovation Build, on Nov. 6-7 in Atlanta, helps attendees understand how to “do” innovation better. It is designed to offer best practices, to guide the innovation professional to better results. Register here.