With Plaid, Wells Fargo gives customers a new lever to control their data

Wells Fargo has entered into a data-sharing agreement with aggregator Plaid in an effort to safeguard customer data and, consequently, enhance customer control over their account information.

With the advent of third-party payment apps, mobile banking and subscription services, customers’ financial lives increasingly are spread out across various locations. Until recently, Plaid, whose tools let banks share customers’ data with third-party fintech apps, used a practice called ‘screen scraping’ to acquire Wells Fargo customer data. That practice essentially allows a third-party app to log into a banking application as if it were the customer, ‘scrape’ their financial data and paste it into their platforms.

With the Plaid agreement, Wells Fargo will connect its customers’ information to third-party apps through application programming interfaces (APIs), which allow apps to securely fetch customers’ data without having to log in on the customer’s behalf.

According to Ben Soccorsy, head of digital payments at Wells Fargo Virtual Channels, the security garnered by an API-based connection puts the customer in the driver’s seat of their financial information. “It’s a major milestone in our journey to provide a more secure and convenient way for our customers to have transparency and control with how they share their data with third parties,” he said. “Our preference is that our customers don’t share their bank username and password with any third party — this has been a practice for which [the industry] has been trying to find a better solution.”

Plaid works with 15,000 banks and claims to work with 80 percent of the largest fintech companies, including such household names as Venmo, Acorns and Betterment. Plaid also has data-sharing agreements with other large banks, including JPMorgan Chase.

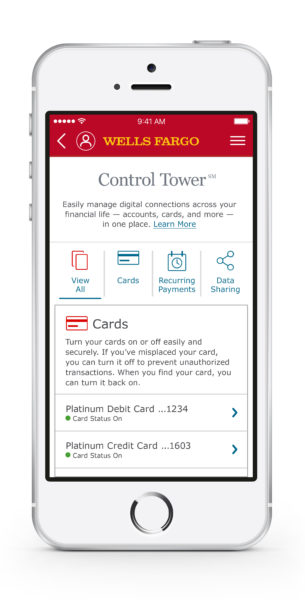

Wells’ agreement with Plaid is its latest initiative to enhance customer control over data and comes nearly one year after the bank rolled out Control Tower, which is a digital control center for all of its customers’ digital financial footprints. This includes cards (including the ability to turn them on and off); recurring payments, such as subscriptions; and data sharing, which gives customers an overview of select third-party platforms with which it shares customer data. With Control Tower, customers can turn data sharing on or off at their discretion.

See also: Wells Fargo using blockchain for corporate international money transfers

Since the rollout of Control Tower, the most commonly used feature is recurring payments, but the Plaid agreement is a big boost to its data sharing oversight function, according to Soccorsy. “The more partners and the more agreements that we make around moving to the data exchange API, the more robust the data sharing list is,” he said. According to the bank, “millions of customers” have engaged with Control Tower since its launch.

Bank Innovation Build, on Nov. 6-7 in Atlanta, helps attendees understand how to “do” innovation better. It is designed to offer best practices, to guide the innovation professional to better results. Register here and save with early bird rates ending September 27th.