In the battle for top of wallet, Citi adds instant card rewards redemption

Citibank is hoping instant cash back rewards at checkout will encourage more card use and grow customer affinity with the brand.

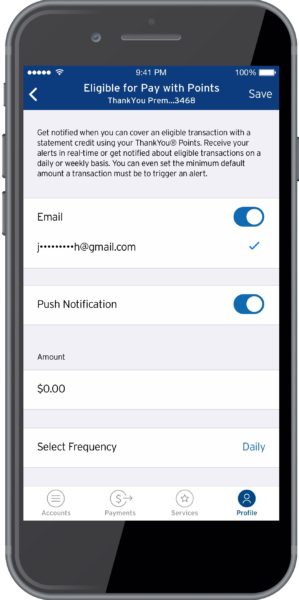

In July, the bank is enabling instant reward redemption capability at checkouts from both Android and iOS devices, for both online and physical store transactions. The feature is made possible through a partnership with Mastercard.

The goal is to encourage customers to redeem their credit card rewards for cash back as frequently as possible — no matter how small the purchase or for partial funding of purchases. It’s an effort to entice customers to make Citi cards their default payment method and encourage customer loyalty.

“Our customers work hard to earn those points,” said Mary Hines, head of customer engagement and innovation for Citi branded cards, in a briefing with reporters Tuesday. “We want to make them as rewarding as possible, and we can deliver personalization by enabling them to redeem for whatever they want.”

Unlike personalization efforts that comb through data to suggest products to customers, personalization through instant rewards redemption puts control into the hands of the customer on how and when they would like to use their reward balances, Hines explained. “You personalize [the experience] by giving the customer the choice to get exactly what they want from the merchant, dining and entertainment establishments,” she said. The bank declined to comment on the specifics around which purchases are eligible beyond “most of the things you do every day — dining, shopping, entertainment — are eligible.”

When asked whether encouragement of small redemptions reduces the bank’s balance sheet risk due to unclaimed rewards, Citi said the bank’s motivation is to encourage card use to build more of an ongoing relationship with the customer. “When people redeem, they’re more engaged and more loyal to your brand,” said Hines.

According to Ted Rossman, analyst at CreditCards.com, instant rewards redemption is a tool to encourage more frequent use of Citi’s cards among its customer base, with the objective to make Citi cards the most commonly used payment method among its customers. “It’s all about which card is at the top of your wallet — it’s where all issuers want to be,” he said. “It’s whatever gets you to use that card more regularly. That’s why ongoing rewards are becoming more important than sign-up bonuses.”

The instant rewards redemption feature launched one day after the bank eliminated benefits from many of its cards effective Sept. 22, including a “price rewind” feature for online purchases along with trip cancellation and interruption protection. The bank reportedly cited “sustained low usage” as the rationale for the move.