Buckets and Boosters: Ally automates saving

Ally Bank is taking a page from fintech startups by rolling out auto-save features to encourage better money habits among its customer base.

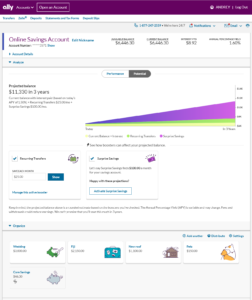

This week, the digital bank rolled out Buckets, or digital savings envelopes; and Boosters, which are automated contributions to savings accounts that can be tied to any U.S.-based checking account, even if it’s with another institution. Ally said the rationale for the feature rollouts is not just to follow startups, but create tangible ways customers can put aside money. The bank can use insights from the trove of transaction patterns to influence the launch of future products and services.

“There are kind of been fintechs that have had rolled out similar kinds of functions, but what we’ve heard directly from our customers is that they want that kind of functionality with their bank, seamlessly integrated into their existing experience,” said Anand Talwar, deposits and consumer strategy executive at Ally.

Buckets and Boosters resemble features fintech companies have launched in recent years, like a savings envelope feature called “Pots” that U.K.-based Monzo integrated into its platform, and the automatic savings capability of personal finance app Digit.

Talwar explained that that Boosters, which facilitate automatic deposits into customers’ savings accounts, work two ways: customers can specify an amount to be taken out on a regular basis, or the platform can analyze customers’ transaction patterns and determine a safe amount to put away. The automatic savings option will not remove more than $100 at a time.

Ally has created a series of Buckets options, and customers can add new categories as often as they wish, with the bank studying their behaviors and adding new categories over time. According to Talwar, major advantages Ally has over fintech startups carrying out automatic savings features are price, since Ally’s automatic savings features are free; and transparency, since with third-party fintechs, customers don’t always know what happens to their funds once it’s handled by a partner institution.

See also: No one-trick pony: How Ally got to $100B in deposits

“[Fintechs] are using some other institution to custody the funds, so you lose a little bit of transparency,” he said. “Having that functionality within our four walls allows you to have the best of both worlds.”

The bank’s development cycle for Buckets and Boosters took 18 months in total, from concept to launch, Ally said. The initiative was led by seven staff members who worked autonomously to study consumer behavior and develop product prototypes at TM Studio, Ally’s Charlotte, N.C.-based innovation studio. The tool was mostly built in-house, according to Talwar.

In the third quarter of last year, the bank made the product available to more than 100 employees for an eight-week beta test. In the fourth quarter, Ally rolled it out to a broader group, initially starting with thousands of customers and eventually testing the product with more than 200,000 customers, Talwar noted.

“The process of the rapid prototyping helps accelerate some of the problems that the team had run into and bringing [the product] a commercially viable state,” Talwar said. “When [the team] came out of the prototyping phase, they had probably identified maybe 60% or 70% of the user flows that needed to be accommodated over the long term.”

Banking Automation Summit, which takes place from June 1-2 in Miami, is a unique opportunity to share insights, trends, strategies and best practices on back-office automation in financial services with the industry’s leading practitioners. Register here.