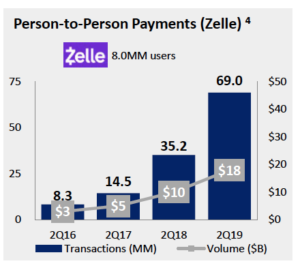

BofA: Zelle peer-to-peer transaction volume grows by 79%

Consumers who send money to family and friends are converting to digital peer-to-peer payments in droves, if Bank of America’s Zelle numbers are to be believed.

The bank-owned the peer-to-peer payments network, which launched as a brand in 2017, is growing in adoption, despite the continued popularity of third-party apps like PayPal-owned Venmo and Square’s Cash app. According to BofA’s second-quarter earnings report, customers made 69 million Zelle peer-to-peer transactions, with a payment volume of $18 billion, during the quarter — a 79% increase in payment volume year-over-year and a 260% increase since 2017.

Despite the uptick in peer-to-peer payments, whether Zelle numbers can be compared to third-party apps like Venmo or Cash is still the subject of debate. “A lot of BofA’s Zelle volume is simply a migration of existing account-to-account transfers to Zelle,” said Ron Shevlin, research director at Cornerstone Advisors. “I doubt any of this volume reflects a shift from Venmo or Square to Zelle.”

BofA’s Zelle payments push is one component of the bank’s bigger digital strategy, which is generating strong user growth. The bank has steadily moved transactions, which used to occur in branches, to its app with the help of intelligent assistant Erica and other features, including digital card issuance capabilities.

The bank’s active mobile and digital user numbers, which were part of the company’s second quarter earnings report, appear to indicate that consumers are responding positively. At 27.8 million, the bank’s active mobile banking user numbers grew 10% since the same period last year, while active digital banking customer numbers (which includes desktop mobile banking) grew more modestly by 4% to 37.3 million users.

With the shift to digital, however, BofA has been careful not to alienate customers who prefer to go to branches, and its customers have the ability to book in-person appointments through the app. “We have to be both high touch and high tech,” Lee McEntire, senior vice president of investor relations at the bank, told investors on Wednesday’s earnings call. “Customers want both physical and digital access.” By way of illustration, the bank highlighted that, in the second quarter, customers used digital channels (both desktop and mobile) to plan 583,000 in-person appointments in branches — up 10% year-over-year.

Looking ahead, BofA is leaning into its growing millennial customer segment, which it said now stands at 16 million. “Millennials are very important for our growth, and they hold nearly $200 billion in deposits and investments with us,” McEntire noted.