Financial Services and Data exhausts

I had the luck to be invited again to Finovate 2012 as a blogger, the leading conference for financial services startups and innovation. The mix of participants is always interesting, from startups claiming banks are dinosaurs on stage to core system providers demonstrating tablet interface using Arial 10 fonts and stylus on an HP table (not kidding). You see my bias.

But one of the most interesting piece of news I got was in a conversation with Kabbage. I have written before on Kabbage and its use of outside source of information for underwriting purpose. With Ebay / Amazon / Etsy score and information, it was conceptually easy to understand how this data could be a direct link into the financial performance // risk of loan.

But it takes things to a next level when Kabbage announced me that they will partner with UPS to access delivery data to better underwrite their loan. This has been publicly released since then:

Banks, payment networks,… potentially sit on top of valuable data, in the aggregated data exhausts of their clients (payments, allocations, assets etc..). But banks, financial services startups also need to consider there are other sets of data out there, generated by their users diretly or indirectly that can be leverage to disrupt their activities. These data exhausts may contain useful signal for underwriting, marketing, intelligent banking, etc..

These source of datas may be as close as trying to leverage prepaid card data spending patterns to see if they could add information to someone’s credit score or as far (for now) as understanding what role reputation and social media activities could play (with services like Peerindex or Klout / Anthemis is an investor in Peerindex). Business reputation could also be leveraged, with reputation score on platforms like Yelp being used to verify the quality of a business to allow him to accept various payment methods.

But, as seen with Kabbage, we may have to expend our view further. The best way to do it would be to start from the customers’ multiple data exhausts, with no preconceived view on how useful they may be. If someone’s ability to manage a farm on Farmville is a possible indicator of their capacity to manage their money, why not use it?

—————-

More startups working on integrating other data exhausts in financial services:

Lenddo: Lending integrating social scoring:

What is Lenddo?

Lenddo is a scoring engine that analyzes your online social footprint (sometimes called a social graph) and provides a score that can be used to access financial services such as personal loans.

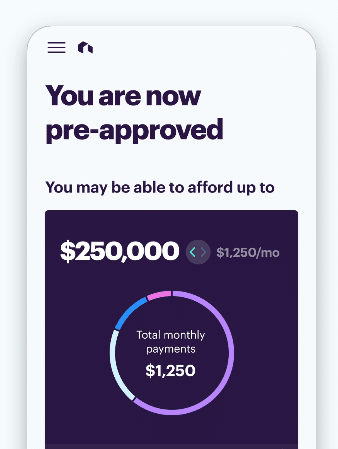

Movenbank: Mobile Only Banking integrating a credibility score

What is CRED™?CRED™ is a measure of your credibility as a friend, colleague and customer, and it is a vital part of our reboot of banking. It will equalize the playing field between your value to Movenbank and our value to you and will help you understand the context of your day-to-day financial decisions as you make them.

CRED is what will really change banking for people moving forward. Gone will be the days of mysterious credit scores, rejections by the ‘credit department’ and all those hoops that banks and credit companies make you jump through to prove yourself before they’ll let you be their customer.

CRED puts you in the driver seat and gives you control over your financial future in a way that has never before been possible.