Too small to fail: Can small banks do what the giants can’t with digital offshoots?

Some of the largest banks in the world have stumbled this past year with their forays into stand-alone brands. Last summer, JPMorgan Chase shuttered its stand-alone app, Finn. Royal Bank of Scotland followed suit with Bo in May. Wells Fargo & Co.’s Greenhouse is still in a seven-state pilot — after more than a year and a half since the pilot’s launch.

“We don’t look at those kinds of things like failures at all,” Chase CEO Jamie Dimon said on a call with investors last year after the decision to shut down Finn. “That is how you learn. [Founder and CEO of Amazon] Jeff Bezos will tell you mistakes are good, mistakes are what make you smarter and better, and so I hope we make some really good mistakes that can teach us in all our businesses at some point.”

But while big banks have struggled, many community banks are still aggressively pursuing their own stand-alone digital brands. The reasons are varied for why banks with less than $5 billion in assets are trying to accomplish what trillion-dollar banks have not.

There are at least four small banks that have launched stand-alone since 2019, largely driven by vendors hawking digital bank solutions, Bank Innovation research has found. The smallest has but $233 million of assets.

Midwest BankCentre’s digital offshoot Rising Bank, for example, gained $130 million in deposits in 2019, while Pacific National Bank’s standalone brand Facile has seen hundreds of applications just months after launching. The question remains why they believe they can see long-term success?

Go nimble or go home

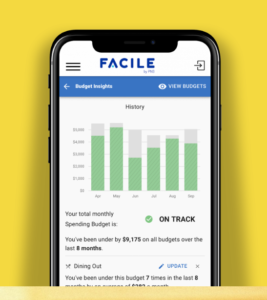

Miami-based Pacific National Bank, which has $665 million of assets, launched Facile to secure more younger customers earlier this year. The digital bank account, which runs on technology from the software provider Nymbus, offers spending breakdowns, peer-to-peer payments, bill pay and debit cards. The bank gained 800 applications for Facile in about three months, a number Carlos Mejia, senior vice president and chief digital executive at PNB, felt was a solid start.

Mejia said larger incumbent banks lack the agility of smaller institutions like PNB, and the size of larger banks makes it harder to differentiate two brands, which can lead to cannibalizing existing customers. Mejia added that community institutions don’t suffer from as much bad press as their larger counterparts. Negative headlines can tarnish a bank’s stand-alone brand, especially given the stand-alone offerings are often targeted at younger consumers who generally care about social issues more than older consumers. According to 5WPR’s 2020 Consumer Culture Report, 83% of millennials want to buy from companies that align with their values.

Beyond trust, big banks often struggle to create stand-alone products that differentiate from their main mobile offerings. The stand-alone brands from some large banks have offered only basic money movement and personal finance management functions that don’t add enough value to merit widespread adoption, Celent senior analyst Stephen Greer said.

“Whereas some of the standalones I see from community banks are solving issues that their specific niche of customers have,” he said. “The propositions seem to be a little more focused and interesting.”

For example, Merrillville, Ind.-based Centier Bank, which has just under $5 billion of assets, last summer launched its gamified savings app Billinero, which enters consumers into monthly and quarterly prize drawings, depending on how much they save. Every time a Billinero user makes a deposit of more than $25 into the app, they are entered into a monthly drawing for a chance to win $1,000. If users make three deposits of more than $25, they are entered into a quarterly drawing for $10,000.

“We’ve seen so much of the world become gamified, whether you’re winning stones or gems or whatever it is,” said Chris Campbell, senior partner at Centier Bank. “It’s a way to visually show your progress.”

BankMD, meanwhile, is the stand-alone brand of San Antonio-based TransPecos Bank. TransPecos’s digital offshoot specifically serves doctors, many of whom start their careers with a large amount of medical school debt. By offering physicians mortgages and bank accounts, the $233 million-asset bank can reach clients beyond its three branches.

Stand-alone brands can also offer a way for community banks to update their technology while locked into a core contract with a legacy provider, Greer said. Some core contracts stipulate that banks cannot license multiple cores on the same charter. As something of a workaround, community banks instead can use software vendors to launch standalone brands because it counts as a hosted service and not a new license. This allows community banks to upgrade their tech through the stand-alone brand while their main offering is running on the old core. Once the core contract is up, banks can take many paths, one of which is fully migrating to the stand-alone brand’s technology.

The race is on

Given the wave of institutions launching digital offshoots, many banking software providers are tailoring their offerings to meet the new demands. BankMD, Billenero and Facile all run on the Miami-based Nymbus’ SmartLaunch solution. Banks using SmartLaunch can outsource call centers, digital marketing and website services to Nymbus, without requiring an overhaul to their core technology. The company has reached “thousands of accounts and multiple millions in deposits for our SmartLaunch clients,” according to Nymbus.

Nymbus says SmartLaunch can create a digital offshoot in 90 days, which has become the industry standard time frame. Jack Henry, Temenos and FIS all offer digital bank starter kits that can stand up a brand in 90 days. “There’s a great demand in the marketplace to have a core banking platform that’s nimble and built around API technologies,” David Albertazzi, research director at Aite Group, previously told Bank Innovation.

While larger banks have struggled with digital stand-alones, smaller banks have their own limitations. Celent’s Greer said smaller banks lack the household name of big banks to boost their product launches. Marcus by Goldman Sachs, for example, has benefited from having the Goldman Sachs name behind it since its 2016 launch. Marcus is Goldman Sachs’ first venture into retail banking, so it doesn’t have to worry about cannibalization or balancing two separate financial depository brands. As of April, Marcus had attracted $72 billion of deposits since its kickoff.

Standalone apps from bigger banks, meanwhile, are often built on banks’ existing tech stacks. In the case of Marcus by Goldman Sachs, the 150-year-old bank built the digital offshoot separate from the core financial system that runs Goldman.

“Oftentimes you are strapped with legacy technology or legacy products, which could potentially disrupt doing it the right way,” Dustin Cohn, head of brand and marketing, recently told Bank Innovation. “We really built [Marcus by Goldman Sachs] from scratch, so it was having the stability, backing, resources and expertise of Goldman Sachs with this entrepreneurial startup spirit and a blank sheet of paper.”

Smaller banks often piecemeal their products together from multiple vendors to get a new brand standing. Rising Bank, launched by Midwest BankCentre, runs on a buffet of tech solutions: Jack Henry’s SilverLake System Core, MANTL’s account opening technology, Alloy’s know-your-customer solutions and Synechron’s website design services. Midwest, which has $2 billion in assets, treats Rising Bank like a mini lab and incorporates the lessons learned across both brands.

“Our long-term goal is to continue to distinguish our Rising Bank brand,” said Dale Oberkfell, president and CFO of Midwest BankCentre. “Our efficiency has been very effective with Rising Bank.”

See also: Jack Henry the newest core provider to offer a digital bank in 90 days

The path forward for digital banks, Celent’s Greer said, will depend on the financial institution. Some smaller banks in remote areas might migrate completely to their digital offshoot if their main brand is struggling. Others might run the two brands in parallel, while still others will shutter the stand-alone brand and pull its technology into the legacy brand.

“I’m sure we’ll see all kinds of different options,” Greer said. “But it’s heartening to see community banks are finding that niche and creating value.”

Bank Innovation Build, which will take place Sep. 9-10 as a virtual experience, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services.