BofA integrates digital SMB tool with third-party platforms

Bank of America is enhancing the capabilities of its digital cash management tool for small businesses, Business Advantage 360, by integrating with third-party platforms, including QuickBooks, Run Powered by ADP, G Suite by Google Cloud and Google Analytics.

“Businesses go out of business many times because they don’t manage their cash flow properly,” said Sharon Miller, head of small business at Bank of America. “Business Advantage 360 was developed to help business owners manage their cash flow. In the first iteration, it only pulled together what they had at our institution.”

The bank, which rolled out the upgrades last week, said it aims to create a better customer experience for small business clients with the integrations, as the accounting and payroll data from the third-party platforms can deliver more accurate cash flow predictions. Miller said the improvements will also help small business bankers understand their clients better.

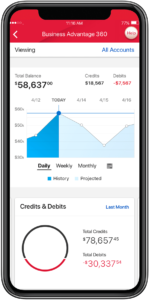

Business Advantage 360, an online tool available through desktop and mobile, provides business clients with real-time cash flow analysis and projections by examining data like credits, debits and new sales. The bank said in a statement more than 1 million business clients have used Business Advantage 360 since it launched in February 2019. The new integrations have been in the works at Bank of America for almost a year.

See also: Digital and human: Inside BofA’s small business strategy

Miller said the upgrades improve service by making conversations with bank advisers more relevant. She said accounting and payroll information from third-party platforms gives advisers a better picture of business clients’ financials. She added that the bank has grown from about 1,200 small business bankers in 2015 to more than 2,200 today.

According to Miller, more than 12 million business owners bank with Bank of America in some form; some clients only use small business features, while the majority use retail banking functions, and just over 1 million use both. Because business owners use the bank through different channels, it is launching a single sign-on feature so clients can view their business and retail accounts in one place. The bank has already started rolling out the feature and plans to have it widely available by Feb. 20.

Miller said Bank of America has more than 400,000 members in its Preferred Rewards for Business program, which offers business clients rewards, such as higher savings account interest rates and discounts on business loans. The bank said in a statement it had originated more than $9.2 billion in new small business loans last year, a 7% increase from 2018.

Banks are increasingly trying to use cash analysis tools and third-party integrations to improve their small business offerings. RBC, for example, provides AI-based insights to business clients, while BBVA’s small business banking platform Azlo integrates with accounting software like QuickBooks and Xero.

Bank Innovation Ignite, which will take place March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations.