Citi appeals to socially conscious investors with City Builder

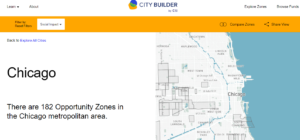

Citibank will try to connect investors with neighborhoods in need through City Builder, a new digital tool launched last month. The searchable web platform allows investors to research and invest in “opportunity zones,” or areas in need of economic development, where investors get tax breaks for investing their capital gains.

“It’s a market-driven approach to economic development,” said Valla Vakili, managing director and head of studio at Citi Ventures. “There’s a lot of capital gains out there on the sidelines looking for a place to invest, and there’s a lot of communities in need of investment.”

City Builder allows investors to search city maps for neighborhoods that need investment. With more than 8,700 designated opportunity zones in the U.S., finding information about individual zones previously required data from multiple sources of public records, but City Builder puts all this data in one place. It’s a means to connect investors with new opportunities while broadening Citi’s reach to potential new clients.

With City Builder, investors can filter search results and focus on opportunity zones. For example, investors considering opportunities in Chicago could filter results that include food deserts, affordable housing projects and job opportunities. The tool incorporates recent census data, housing data, transit data and Department of Agriculture information, and investors can also browse funds dedicated to investments in opportunity zones.

The platform is free to use for anyone, including non-Citi clients, and according to the bank, doesn’t generate any revenue from referral benefits or advertising.

Wally Okby, a senior analyst with Aite Group’s wealth management practice, said City Builder could act as a customer acquisition tool for the bank, with appeal to investors focused on making a social or economic impact; the platform also offers a way to realize these goals through the bank, he observed.

See also: Inside Citi Ventures’ internal ‘Shark Tank’ D10X

Opportunity zones were created as part of the Tax Cuts and Jobs Act of 2017. According to the IRS, they are designed to spur economic development and job creation in distressed communities throughout the country. Investors don’t need to live, work or own a business in an opportunity zone to invest and get the tax breaks, and they can invest non-cash assets.

Citi launched City Builder with nine cities, and investors can now explore 25 cities, including Atlanta, New York, Los Angeles, Cleveland, Houston and Indianapolis. Although the tool only works on desktop for now, Vakili said the goal is to have the tool function on mobile in the future.

Citi joins other institutions launching tools to promote economic development. This week, JPMorgan Chase committed $22 million to promote affordable housing in the Bay Area, and earlier this month, TD Bank committed more than $28 million to housing in Fort Lauderdale.

Since opportunity zone investments can last years, Okby argued that City Builder could deepen Citi’s relationship with its wealth management clients, embedding them further into its ecosystem.

“This gives Citi the chance to engage quite often with their clients. You get someone in the door, and they could be a client for years,” Okby said. “It’s the holy grail for a wealth management relationship.”

Bank Innovation Ignite, which will take place March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations. Request your invitation.