Brex to launch treasury, insurance and loan products

Brex, a corporate card and financial product startup aimed at businesses, plans to broaden its product ecosystem beyond bank accounts and cards. Chief Operating Officer Paul-Henri Ferrand told Bank Innovation that the company aims to add insurance, lending and treasury products.

“We’re building our operating system around our real-time underwriting and our financial stack. We think we can deliver a one-stop shop solution,” Ferrand said. “We have about 30% of our business coming from e-commerce. We’ve addressed life science. We’re going to address many other verticals.”

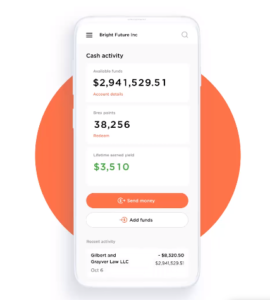

Brex didn’t say when it plans to roll out the new offerings. Despite the growth of its product suite, the company said it doesn’t consider itself a challenger bank. The startup, which was founded in 2017, has raised $315 million in equity and offers card products for entrepreneurs. The limited launch of a cash account called “Brex Cash” in October was the company’s first move beyond cards to deepen its relationship with clients.

See also: With podcasts and billboard ads, Brex focuses on brand building

Ferrand said the Brex Cash account will roll out to the general public at the end of March. In addition to deepening the company’s relationship with clients, the cash account also provides additional cash flow data to help with Brex’s underwriting model. Customers using the cash account get 1.6% APY, as well as points-based rewards on transportation, restaurant and software costs.

Moving forward, Ferrand said Brex’s goal is to continue tailoring customers’ product offerings based on their business. For example, life sciences companies using Brex are eligible for points-based rewards for lab equipment purchases. For startups, Brex offers rewards for rideshare and software purchases.

Brex announced Ferrand’s appointment this week. Prior to Brex, Ferrand spent more than five years at Google, including his most recent role as president of global customer operations for Google Cloud. Before Google, Ferrand served as president of Dell North America.

Despite the crowded field of companies rebundling financial services, a fintech investor recently told Bank Innovation the market has room for many players.

“[With] funds flowing into it, the impact that it’s starting to have, in terms of how the larger traditional institutions are responding, all of this is contributing to a buzz,” said Kelly Ford, a general partner at Edison Partners. “Time will tell if the valuations and capital going into the space will truly pay off.”

Bank Innovation Ignite, which will take place March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations. Request your invitation.