Canadian neobank Koho to launch credit and savings products in 2020

Koho, a Toronto-based digital banking startup, is on track to expand its product suite to include credit and savings products in 2020, CEO Daniel Eberhard told Bank Innovation on Wednesday. The company offers checking accounts, debit cards, personal finance management services, foreign exchange tools and cash back programs for Canadian consumers.

In late November, the company closed its Series B round with C$25 million ($ 18.9 million) in fresh funding led by Drive Capital. The National Bank of Canada’s corporate venture arm NAventures also participated in the round. The new funding will propel Koho’s product expansion and allow it to grow beyond its 200,000-strong customer base, noted Eberhard.

“Today, I think we do the current account very well; where this accelerates is into a broader use case, meaning paying interest and getting into credit — a more full suite of what we call primary banking needs,” he said.

The savings and credit products will launch in beta in early 2020. Koho, which was established in 2017, entered the market as an early mover among digital-only challenger brands in Canada. Despite the rise of other digital-only players like EQ Bank and digital banking offerings from incumbent institutions, Eberhard noted that Koho’s primary competition is major incumbent Canadian banks, which together make up more than 90% of the Canadian market share.

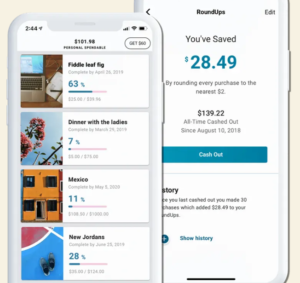

Koho is differentiating from incumbents through its tech-forward approach, low costs and fee transparency. The company has also rolled out cash back partnerships with retailers along with a price-match mechanism at checkout that verifies if customers are getting the lowest possible price on purchases. In October, it launched a partnership with TransferWise to minimize foreign exchange fees. Koho currently offers two product bundles for its customers, including a basic free account and a C$9 ($6.82) per month premium account that includes 2% cash back, no foreign exchange fees and free financial coaching.

See also: Canadian Startup Koho raises C$42m to expand banking services

Adam Felesky, CEO of Portag3 Ventures, a major investor in Koho, recently told Bank Innovation that the Canadian market is ripe for a digital-only challenger to major banks. He argued that one winner will emerge as a digital-only banking alternative to incumbents.

“Because of the oligopoly nature of Canada, there’s been a huge under-investment in [incumbents’] infrastructure and technology,” he said. With the tailwinds of technology advancement, changing consumer behavior and the evolving regulatory landscape, it’s the right time for a “new age” digital bank to come to the Canadian market, he added.

Koho has so far raised C$62 million ($47 million) in total. Portag3 led Koho’s Series A round and was a major participant in its Series B round. Koho’s November funding injection, which was led by Columbus, Ohio-based Drive Capital, brings in its first U.S. investor. Meanwhile, the participation of the National Bank of Canada’s corporate venture arm offers the perspective of a large incumbent Canadian bank.

The presence of a U.S. investor like Drive Capital ensures a diversity of views among the company’s funders and is an important enabler for continued growth, Eberhard explained.

“If you want to build a large-scale business, you need more than one funder on the table; otherwise, it just gets too capital intensive for a single partner,” said Eberhard. “This is about bringing in a U.S. tech venture capital perspective. It’s important that you don’t have a homogeneous board and a homogeneous perspective.”

As Koho expands its offerings and encroaches closer to bank territory, Eberhard confirmed that the company has no plans to apply for a bank license at this time. Koho currently partners with Vancouver-based Peoples Trust.

“In the short term, we don’t [intend to apply for a bank license] — we don’t find that there’s things that we can’t deliver to customers today without a bank license,” he said. “Eventually [a bank license] makes sense from a scale perspective and a product experience perspective, but we’re just not there yet.”

Bank Innovation Ignite, which will take place on March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations. Request your invitation.