Affirm rolls out virtual card for checkout loans

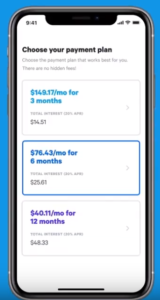

The point-of-sale loan is evolving to a digital card that feels like a credit card but isn’t nearly as tough on customers’ budgets.

On Monday, point-of-sale lender Affirm rolled out a new app that allows customers to shop at “virtually any store” and split their payments over time. The new app avails customers of the credit option even if the brand hasn’t formally entered into an arrangement with Affirm. The firm previously offered its product only in partnership with a network of retailers.

Affirm is integrated with more than 3,000 merchants (physical and virtual) in home furnishings, travel, personal fitness, electronics, apparel and beauty categories. The new app makes point-of-sale loans available for non-integrated merchants, but it excludes medical, grocery expenses and subscription services.

See also: Affirm, Lending Tree CEOs tout gains among young borrowers

Ellen Kiehl, Affirm’s manager of consumer communications, explained that, for non-integrated merchants, customers open the Affirm app and select the merchant. Before they proceed to the merchant’s site (from within the Affirm app), they can pre-qualify by providing five pieces of identifying information (name, phone number, email address, date of birth and last four digits of their social security numbers) for a soft-credit check. Once approved, a customer can use the virtual card to pay for an item on an e-commerce site. Customers also can use virtual cards via Apple Pay and Google Pay in-store.

As a growing number of banks and startups competing for market share with point-of-sale loans, the capability to use Affirm’s tool outside of its network of integrated retailers offers a competitive edge. Kiehl emphasized that the point-of-sale loan method is preferable to younger customers who would prefer not to be saddled with the burden of revolving credit, hidden fees late fees or deferred interest, which Affirm said it doesn’t charge. Indeed, Affirm CEO Max Levchin recently confirmed that roughly 67% of his company’s customer base is Generation X and younger.

Banks also are building point-of-sale loan capabilities to serve a growing market as startup competitors like Afterpay and Splitit grow their relationships with brands. Among banks, Citizens Bank is partnering with Apple on its point-of-sale financing program, and Ally Bank recently finalized its acquisition of Health Credit Services to expand its point-of-sale lending capabilities. It’s a model that’s yet to be tested in a recessionary period, as Aite Group senior analyst Leslie Parrish has observed, but financial services companies are bullish on its prospects because of the “complete transactional-level flexibility” it offers consumers.

Affirm generates revenues from fees merchants pay to offer the payment option. Interest rates vary depending on the retailer, ranging from zero to 29.99%. The loans are offered in partnership with Affirm’s bank partner, Cross River Bank.

According to Kiehl, Affirm is exploring the expansion of the model to other areas beyond retail, though she didn’t offer specifics. “Customers overwhelmingly prefer Affirm because of the simplicity and transparency of our terms. They’re constantly asking for more places and more ways to use it, and we’re definitely thinking about how we can enable it in more places in their lives.”