Investing, Authentication, and a Few Bots at Finovate

SAN JOSE, Calif. — Thirty-nine companies demoed their products to the crowd at Finovate Spring today. Not all were startups (IBM) and not all were really fintech (Quid). All of them did their best to impress a passionate crowd of 1,500+ fintech fanatics. Here’s our take on the demos from Day 1 of Finovate Spring 2016, followed by our choice for the winners of the day:

Payment Data Systems showed off Akimbo, which offers instant delivery of virtual cards via text message or email. Cards can be used for in-store purchases via Apple Pay, as well as P2P, gifting, and even disbursements for businesses, for which white-label solutions are available. Virtual cards mean lower costs and a better customer experience, SVP Houston Frost argued. A partnership with HCE veteran SimplyTapp helped solidify Android wallet solutions.

Florida-based Finova Financial offers equity line of credit based on automobile values. The company notes this can help strapped consumers rebuild or establish credit with loans that coast 70% less than title loans. The approval process is fully mobile, and Finova recently got a new line of credit, bringing the company to $50 million. A Mr. T action figure and A-Team van played a prominent part. Not mentioned? Defaults and repos, which could be considerable.

CallVU offers “mobile digital engagement” that is intended to bridge the gap between the phone channel and digital channels. Essentially the service is pushing callers to digital: “We’re leveraging digital channels to deflect calls about simple transactions,” VP of Product Assaf Frenkel said. The platform is multifaceted and leverages video calls.

OurCrowd was the first of several companies at Finovate today that offered access to private deals. The startup has raised $280 million in three years with six exits. OurCrowd investors get expert advice and vetting from industry experts, and can mimic their investment moves. OurCrowd, like CallVU, is Israel-based and is already a major access channel to Israeli startups.

San Diego-based Empyr, formerly known as Mogl, drives commerce online to offline via card-based offers. Marketing is key to the platform, CEO Jon Carder calls it “fintech plus adtech.” Users link cards to the app and receive offers at participating merchants automatically. Empyr partners with ISOs and merchant processors to sign merchants.

MeetInvest offers algorithm-driven robo-advisory services with social sharing collaboration at its heart. Users build a team of experts whose guidance they can follow via their educational investment “cockpit.”

Kofax, known for its imaging services, showed off a KYC/AML solution. The company cited 70% cost reduction with digital vetting, and noted that manual processes can mean 41 days to onboard high-net-worth clients. The first mention of “bots” emerged with Kofax’s robot, which FI employees can build to streamline ID validation. The “robot” in question appeared to be a script or automization of manual processes.

Qumram records digital transactions to validate them and provide a comprehensive audit trail. The service offers “movies” showing everything users did online or mobile — “every click and keystroke.” Qumram also covers social channels.

Kore showed off its bot Kora, text-based bot for customer engagement that can operate across multiple channels including Amazon’s Alexa. Kora can escalate customer requests or move them to more optimal arenas.

Linqto is an app store for financial services companies. Banks can create branded apps with the touch of a button and rapidly deploy a fintech app to 12.3 million credit union customers affiliated with Linqto. The technology looked strong, but the use case for FIs less so. Creating apps with a bank’s logo (particularly Wallaby, which could push other FIs’ cards to your customers) may not be appreciated by regulators.

Nymbus showed off its modern core system again. The system looks great, with a smart search interface, and a 360-degree of the customer under a single sign-on. Everyone knows banks need modern cores, but it’s a huge task. Recently (at FinDEVr) Nymbus appeared to be attacking middleware and peripheral offerings of core vendors. This seems like a more predictive approach than trying to sell a new core.

OneVisage uses 3D imaging to authenticate users’ faces in order to fight identity theft. Secure account login with selfies is nothing new, but 3D and video is. OneVisage also said it could defeat video replay attacks, but a bug on stage prevented this — great tech, but bad luck. Back to the drawing board.

Payment Ninja is making card payments free for global merchants. Users are presented with an array of payment options choose from, and pay no fees. No one seems to pay any fees. but somehow there is revenue, presumably. There were several ninja costumes, and moderate martial arts on stage during the demo.

Student Loan Genius showed off an employer-offered program to pay down student loans. Employees pay off loans faster, and refi at better rate. Employers can attach student loan benefits to 401k plans. Employers should offer more student loan repayment options as incentives — millennials need this. The company is currently in a pilot with Prudential.

PFM-driven financial wellness app Moven showed off its TD Bank implementation currently live in Canada. CEO Brett King called Moven the “first downloadable bank account in the world.” TD says money management tools pre-Moven were a chore. King said 54,000 have already signed up for TD’s Moven implementation.

OmnyPay is a solution for merchants to offer mobile rewards programs. Connecting the POS and mobile device allows consumers see discounts applied in realtime on their device. The idea is to digitize commerce situations, and OmnyPay is essentially a mobile wallet with additional features.

Earnix is built to optimize pricing and attract optimal customers for financial institutions. It includes dynamic portfolio views and analytics to evaluate the success of various models. The single product works across multiple portfolios to maximize revenue, the Israeli company says.

NCR showed off a digital wallet that can help customers with ticketing, parking, and various mobile payment and ordering scenarios. It also offers transaction tracking, and dynamic line items with SKU level data, as well as PFM and spending analysis. The offering appears to be a Digital Insight product, though the brand, bought by NCR in late 2013, was not mentioned.

Enterprise cloud service Flybits uses aggregated external social data to add context to consumers’ mobile app experiences. Bankers create contextual rules to help them better understand customers’ lives and financial habits.

OutsideIQ’s DDIQ is a due diligence service that taps external, public data. This unstructured data is used to find risk in people and companies, and inform compliance officers of possible red flags. It is currently used by more than 40 FIs.

EquityZen offers another service to invest in private companies. Over $200 million in equity hit the platform last year CEO Atish Davda said. The platform features full investment tools and expert research, and also offers ETFs or “baskets” of private companies. The minimum investment: $20,000. At Finovate, EquityZen announced an institutional toolkit to manage multiple clients.

IBM debuted an impressive wealth management product. Use of predictive analytics (and Watson?) helps manage the risk of the long tail of riskier clients. Wealth managers spend too much time prospecting and worrying about risky customers and don’t spend enough time with best clients, IBM argued. An interesting demonstration of customer personality and stress levels appeared to be a harbinger of things to come.

Realtime mobile and web security are the purview of Cybergend, which protects 100 million users in over 50 countries. CEO Sreenath Kurupati showed off some code on stage to show how hackers take over accounts. Dashboards and APIs — things that make users’s lives easier — can also open up accounts to hackers.

In one of the more moving and memorable Finovate presentations in some time, BanQu showed how the blockchain and selfies can be used to help build identifies for dispossessed and stateless people. Many people lack identity documents due to extreme poverty or being forced to flee their homes due to violence or famine. This is a strong use case for the blockchain — providing identities and dignity to people in order to facilitate financial transactions and building medical histories.

SaleMove discussed bringing the branch experience — meaning the human touch — online. (Considering millennials prefer texting and self-checkout, is this backward?) SaleMove allows conversations to start online as they used to do in the branch, including video chat. Similar to CallVU, it offers a handoff from phone to digital channels.

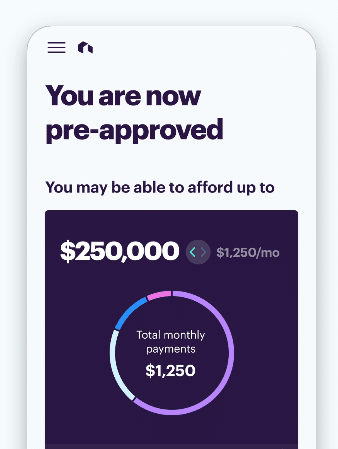

Roostify offers “fast, easy, transparent home lending,” all on mobile. Borrowers can connect to their bank accounts, tax preparers, employers, and other accounts. Shades of Rocket Mortgage?

WorthFM is an enhanced robo-advisor for wealth management for affluent or rising affluent women — all 26 million of them. CEO Amanda Steinberg described the proprietary system as a kind of Myers & Briggs test for financial perosnalities. WorthFM is not focused on portfolio and returns: “Women don’t want different financial advice, but they want financial advice delivered differently,” Steinberg said.

Fintonic provides advice-driven mobile banking for millennials that uses more than 1,000 data points to approve a loan. No Fico scoring is used, and approval is immediate. In widespread usage in Spain, Fintonic combines a product marketplace and analytics with traditional mobile banking functionality.

CRMNext does more with CRMS, such as helping with mobile and web account opening. “It’s clear that account opening should be a part of CRM,” said CEO Joe Salesky. CRMs are central to financial services and capable of transforming the customer experience by giving banks the elusive 360-degree view.

Civic offers realtime identity alerts to fight identity theft. Why do customers not get alerts when accounts are opened using their social security numbers? With Civic, they would. Banks can partner with Civic or integrate its services via API. The product launches for consumers on June 8.

SaveDroid is a Frankfurt-based savings app that encourages “lifestyle savings rules.” This can include, for example, saving $1 every time a user makes an Amazon purchase — an “If This, Then That” for savings. Education is also stressed: “Optimize your learning schedule,” SaveDroid said in proper German fashion. The rules are called smooves — smart saving moves.

Finovate veteran Finovera is a digital bill payment platform for banks and CUs with a strong PFM component, a platform for aggregated accounts and billpay, as well as, unusually, managing bills for families.

Oblo.co is a whitelabel expense report solutions for banks to offer small businesses. “Doing expense reports totally sucks,” CEO Victor Yefremov said. Banks can white label and incorporate the solution so users can file reports on online banking. Making these processes digital can drive down costs from $26 to $6, Yefremov said.

Vera Security offers controlled access to data and assets. Users can secure email attachments, for example, and create lists indicating which users can view, open, or modify the documents. Data is “watermarked” and sent, and tracked and monitored with Vera’s software.

Cunuexs product CPL Express uses deep data analysis to “keep borrowers approved” for auto loans to fix what CEO Dave Buerger calls a broken process. Kabbage, Avant, and Prosper are partners in Cunexus’s loan platform, which extends beyond auto. The company has 14,000 dealer geofences that trigger contextual alerts and loan offers. Insurance quotes are also available.

Quid gathers intelligence and public data and visualizes it to inform decisions. The software collects “clusters” and categorizes data, giving structure to unstructured data.

Mobile imaging company Mitek visually verifies identities for account onboarding. Users hover over their ID documents — licenses, passports — to pull in data and authenticate users. Data is processed in the Mitek cloud.

Neustar helps banks realize what they have for cross-sell and upsell opportunities. Neustar identifies customers in line with strategic goals, and targets them with precision. Interestingly, Neustar combines third-party data with FIs’ own data.

Wealthforge is another take on raising private capital. Entrepreneurs put their offerings on the Wealthforge platform for a capital raise. Industry professionals vet the offering. Capital raising has never been so simple, Wealthforge argues. Others would argue it has never been so ominous.

WINNERS: Kore, Student Loan Genius, IBM, savedroid