Starling Bank on track to reach £1b in deposits by year end

Starling Bank seems to be taking flight, quite literally. In a letter published by CEO Anne Boden earlier today, the bank highlighted the company’s milestones and future goals. According to Boden’s assessment, Starling is on the cusp of reaching break-even status, while many well-funded challengers like Monzo and N26 aren’t yet turning profits.

Like other digital-only banks, Starling touts its lack of branches; in-house tech and lack of legacy systems; and its lean and agile organizational structure as differentiators. Here are the key takeaways:

Customers are signing up

Starling is set to reach one million accounts and £1 billion ($1.2 billion) in deposits by the end of this year, according to Boden. The company already has eclipsed 775,000 accounts – 695,000 retail accounts, 59,000 SME business accounts and an additional 22,000 retail euro accounts. For comparison, the banking startup closed fiscal 2018 in November with 385,000 accounts. Meanwhile, deposits currently total more than £600 million. Starling plans to capitalize on that growth with a television advertising campaign aimed to increase brand recognition in October.

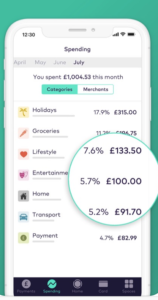

While challenger banks often tout their customer numbers, questions abound about how big customer deposits are and whether they’re using challenger accounts as their primary financial vehicle. According to Boden, Starling customers are relying on their accounts for a significant proportion of their financial needs. The bank reported that over a 12-month period, a typical personal account customer will reach an average balance of more than £1,450 ($1,761), a figure that’s comparable to many High Street banks. For Starling’s business accounts, over a similar time frame, the figure stands at more than £10,500.

Meanwhile, for personal account customers, 32% of active users deposit at least £1,000 ($1,215) into their accounts each month. Among customers who have been with Starling for two years, the figure is 41%. For business accounts, 61% of active users deposit at least £1,000 per month.

Revenue is soaring

In fiscal 2019, the bank’s deposit base grew 200% and its customer numbers grew 110%, driving a 150% increase in revenue, which Boden expects to double by December. She estimates that the company will break even in its UK business by the end of next year.

Starling is adding services at a rapid clip, with a focus on SMEs

This past year, Starling launched a personal loan product on its app, intended for customers looking to finance big-ticket items or to “spread the cost of something after they’ve bought it.” The company also launched accounts for 16- and 17-year-olds and established a partnership with the U.K. Post Office.

Starling Bank is investing £94.8 million ($115 million) of its own money into building its SME proposition. The company aims to reach a “6.7% share of the SME banking market within five years,” according to Boden. It also plans to expand the Starling Marketplace for business accounts with at least 48 additional partners. The Marketplace already added eight new partners this past year.

Continued focus on tech innovation

Boden leaned into Starling’s efforts to use technology to support personalization and curation of offerings for customers. To this end, Starling plans to take machine learning and artificial intelligence and put them “in the service of the customer to create personalized customer experiences and tailored recommendations to best meet their individual needs,” she said. The bank plans to launch a web portal for its business account customers by the end of September, offering customers specialist support, and it’s currently testing multi-currency capabilities for its debit cards.