As fintech adoption grows, incumbents worry about adaptation

Upstart lenders, including startups that offer checkout loans, are rattling incumbents. According to a new study commissioned by Divido, a white-label platform for point-of-sale lending, three of four traditional lenders identified losing ground to new entrants like Affirm and Klarna as a top concern for their business.

Divido, which is backed by the likes of Mastercard and American Express Ventures, surveyed 700 senior IT decision-makers in the banking and lending space at firms with more than 1,000 employees in the U.S, the U.K, Germany, France, Spain, Italy and the Nordics, where the London-based fintech currently operates.

Of the companies polled, 32% said they weren’t confident about competing with the ease with which newcomers can integrate their technologies with retailers’ IT infrastructures. However, two-thirds polled reported they would consider partnering with a third-party platform to deliver lending services to consumers.

Christer Holloman, CEO and co-founder of Divido, said when it comes to lending money to finance retail purchases, most banks still lend through credit cards, which have not kept pace with the changes in consumer expectations.

Technology is a big barrier for banks looking to expand to point-of-sale lending. “A bank can easily spend millions of dollars and take two or more years to build a system that can be offered by a fintech in a fraction of that time and, more often, at a fraction of the cost,” Holloman told Bank Innovation. “In the time it can take for banks to develop a product in-house, potential customers are switching to digital-focused competitors that can already offer the service.”

In addition, the development processes within large banks are often drawn out, requiring multiple sign-offs. “These processes can take months or even years to navigate and can have a detrimental impact on the bottom line in an increasingly competitive marketplace,” Holloman added.

Although banks realize they need to invest in technology to meet consumer demands, the survey found they’re reluctant to do so because of past failures. In the last 12 months, according to the study, IT projects for lenders in the U.S. ran over budget by $11.7 million on average.

Fintech adoption on the rise

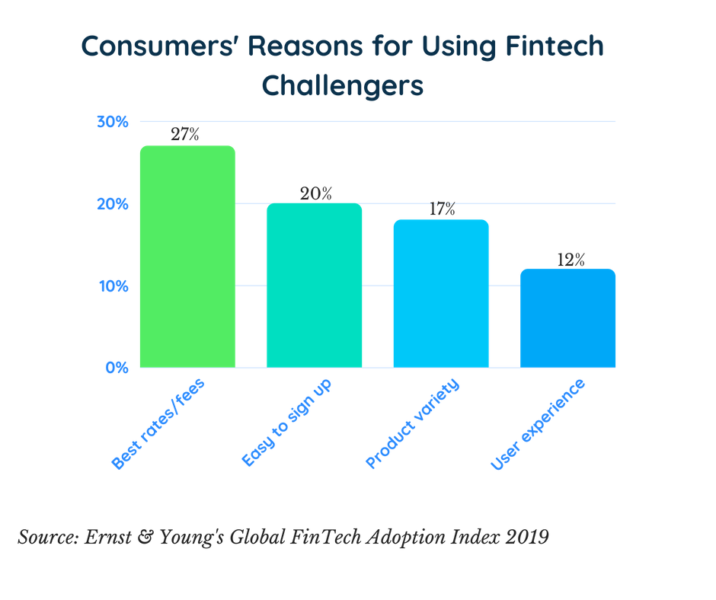

Meanwhile, fintech adoption by digitally-active consumers across 27 markets has nearly doubled over the past 18 months to 64%, Ernst & Young’s recently released Global Fintech Adoption Index found. A fintech user is defined as an individual who has used two or more online or mobile fintech services — including money transfer and payments, budgeting and financial planning, savings and investment, and borrowing and insurance — in the last six months.

Of consumers polled, 27% said they used a fintech service for borrowing in 2019, up from 10% in 2017 and just 6% in 2015. Overall, U.S. consumer adoption has grown by 29.5% over the last four years, according to the index .

Matt Hatch, partner at Ernst & Young and the company’s Americas fintech leader, told Bank Innovation that consumer adoption in the U.S., at 46%, lags behind the global average of 64%. One factor influencing this development, he said, is the rise of open banking, which has advanced from a regulatory perspective in many jurisdictions, including in the U.K. and the European Union.

“That’s been a major factor in terms of the adoption of multiple products and the use of new fintech companies because it’s then easier to port information from one financial institution to another, encouraging adoption in those geographies,” Hatch said.