Rewards app Ibotta closes Series D round, in talks with ‘large banks’

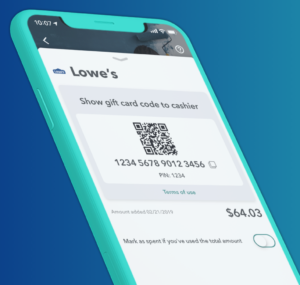

Ibotta, a seven-year-old cashback rewards app, has raised an undisclosed amount of Series D funding, led by Koch Disruptive Technologies, at a $1 billion valuation. The funding will allow the Denver-based company to fine-tune its features, including Pay with Ibotta, a recently-launched QR-code based ‘pay with rewards’ capability; advance its marketing strategy; and grow its team.

“While we’ve reached the point of critical mass awareness when it comes to paying with our phones, there’s still one piece missing on the path to true adoption: rewards,” said Bryan Leach, founder and CEO of Ibotta, in a statement. “We are best-positioned to transform the emerging $100 trillion global payments market. The excitement of cash rewards will be the flash point in changing consumer behavior and driving adoption of new forms of mobile payments worldwide.”

Chief operating officer Kane McCord told Bank Innovation that the amount raised is “significantly larger than any prior round that we’ve ever done.” Prior to the company’s Series D fundraise, Ibotta raised $97 million in total funding. The company has been profitable for the past three quarters in a row, he noted.

As banks try to lure more customers to adopt their payment vehicles through cashback rewards, Ibotta sees this reward method as an opportunity. Ibotta’s cashback rewards rival those of debit and credit cards on the market; first month earnings reportedly are valued at $20 to $25 per month per user. The company currently is in talks with “large national banks” and smaller tech companies, and banks’ openness to the idea of partnering with the company is “very high,” said McCord, who didn’t offer more details.

The Ibotta app offers consumers cash back on purchases, a concept similar to a rebate. The startup earns a commission ranging between 3% and 25% when it delivers a “new trip into [a partner’s] store that results in a purchase,” McCord explained. A portion of that commission is then offered as cash back to consumers.

Users can download and link to their bank accounts or their credit or debit cards. More than 35 million consumers have downloaded the app in the past seven years, amassing $600 million in cash back with more than $200 million expected to roll in this year, according to the company. The cashback rewards are available through the app, and some retailers directly apply discounts when customers shop on their sites through the Ibotta app. Users who prefer to pay in cash have seven days to upload their receipt. When customers reach $20 in their reward balances, they can transfer those funds to a PayPal or Venmo account, or cash it in for a gift card.

The platform has partnerships with more than 1,300 brands and advertisers, and it is currently working with 40 retail chains — including Walmart, Amazon and Home Depot — at a national level. Its QR code-based payments-solution Pay with Ibotta allows consumers to pre-load money and pay both online and offline. McCord said the platform eventually plans to expand so that the payment process is enabled “really everywhere.”

Ibotta wants to use proceeds from its latest funding round to continue to invest in new features, specifically by hiring mobile engineering talent. Right now, the company is working on a peer-to-peer payments feature and is working on rolling out fee transparency capabilities, including how much of the purchase price is processing and interchange fees. The company, which plans to hire “across the board,” expects to increase its hiring rate from between 125 and 150 annually to more than 200. Ibotta currently has more than 600 employees.

The funding also will be used to fuel a marketing campaign via social media, television and radio. Ibotta has been spending upwards of $70 million annually on marketing and plans to “increase that number significantly,” McCord noted.

“We’ve already seen that once consumers are aware that they can pay utilizing this app — and that it’s just as fast if not faster as using any other form of currency, yet it gives them the reward — the repeat usage rates are very high,” McCord said. “So we think it’s an awareness opportunity.”

Despite its potential, Forrester Research principal analyst Peter Wannemacher is pessimistic about the company’s ability to differentiate from similar offerings on the market. “The big headline for me from our research is that this is a very crowded space and that the noise of that crowd of competitors tends to water down the value proposition to consumers,” he said. He noted that the model is similar to Groupon and the audience typically is young heavy mobile users.

Ibotta said it’s targeting millennial parents. “The median user age is around 29 years old, 80% of our user base has at least one child in the household and median household income is right at about the US national average – kind of in the $60,000 or so range,” McCord said. “So it’s typically your tech-savvy, strapped for time, working with a budget type of individual who wants to be rewarded for shopping [and] stretch the investments that they make.”

Ibotta and similar companies should have many opportunities to collaborate with banks, including point-of-sale financing and other white-label solutions, argued Wannemacher. However, he noted that banks should be cautious in their efforts to work with such platforms.