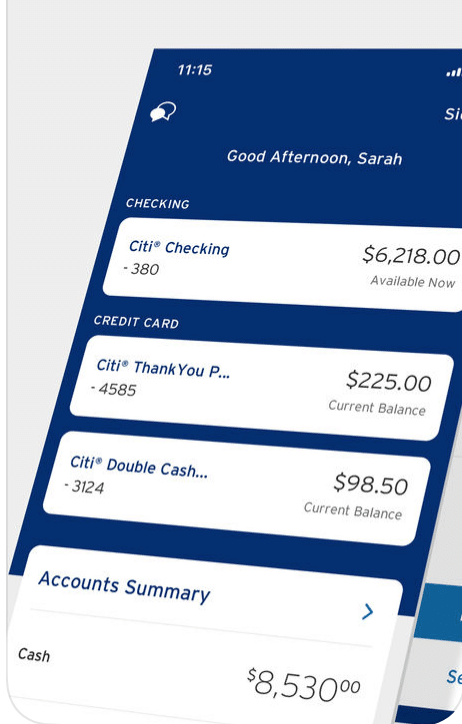

Mobile adoption jumps at Citi

Citibank is reporting strong mobile user growth.

In a second-quarter earnings call today, the bank reported active mobile users grew 12 percent year-over-year for North America customers (11.4 million users) and 39 percent for its international customers (8.9 million users). Meanwhile, online banking grew more modestly, with a 6% increase for North America customers (18.8 million users) and 21 percent for international customers (11.6 million users.)

Bob Meara, senior analyst at Celent, told Bank Innovation that Citi’s slower growth in online users is unsurprising, given the growth of mobile as a channel. “There is very little growth in online banking utilization because, after 20 years, most everyone who would adopt online banking already has,” he said. “Mobile’s growth gets diluted in active digital customer numbers.”

While increasing the number of mobile users is a top priority for Citi, the bank also needs to continue to engage existing mobile clients through added features like personal finance management and predictive analytics, Meara noted. In the U.S., Citi lags behind other large banks in mobile user numbers, with JPMorgan Chase last year reporting 33.3 million active mobile and Bank of America and Wells Fargo reporting 26 million and 22.8 million, respectively, for the same time period.

Citi reported quarterly revenues of $18.8 billion, up 2% year-over-year. Net income for the quarter was $4.8 billion, up 7% year-over-year.