Financial app Qapital hacks the psychology of spending

At first glance, New York-based Qapital, a digital banking, investing and budgeting platform, might look like a challenger bank. However, to CEO and co-founder George Friedman, Qapital’s offerings are more than just a collection of financial products.

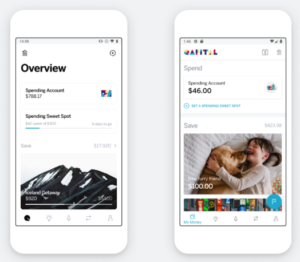

Qapital, which launched in the U.S. in 2015, focuses on the automation of money movement in conformity with the customer’s hopes and dreams. This product objective is what sets it apart from other digital-only banking startups, according to the company.

“We think of ourselves as a way to plan and allocate your paycheck,” explained Friedman. “It’s not about the bank accounts. It’s about this experience of actually managing to change behavior and save money, and put money into things you truly care about.”

Qapital, an eight-year-old company, launched in the U.S. as a goal-based savings app five years ago. It’s since built out its product suite and moved into a subscription model since 2018.

The company’s product bundles include a basic package for $3 per month, which includes a checking account and goals-based savings features. The “complete” package, at $6 per month, adds a debit card, “Payday Divvy” (a tool that automatically apportions money at payday), expense tracking and robo-investing. Meanwhile, the top-tier “Master” bundle, at $12 per month, includes financial educational components and early previews of new features. The platform has 1.8 million users, according to Friedman.

Customers don’t have to use the Qapital checking account (a service offered in collaboration with Lincoln Savings Bank), to take advantage of the automation features.

Friedman emphasized that the automation of money movement is not just about the convenience of dividing up a paycheck. The objective is to ensure customers are emotionally comfortable about their financial situations.

“Think about a freelancer, for example,” said Friedman. “We read the transactions, we have a connection to the balance in realtime and move the funds [into savings and other buckets] as soon as you get paid.”

Qapital strives to make money management both practical and emotionally fulfilling. The challenge for many consumers, according to Qapital, is to break up their budgets into weekly allocations and develop a plan that’s within their means and leaves them feeling their needs are met. “It’s really a sweet spot that we encourage you to find over time,” Friedman added.

While saving money is an important end goal of Qapital’s platform — the platform has saved customers $1 billion since its launch — the objective is to allocate expenses appropriately and spend when necessary.

“I don’t want to underspend. I want to spend it and the goal is to spend it, which is reverse psychology around budgeting,” he said.

Looking ahead, Qapital will be examining how to simplify debt management for its customers. Friedman said Qapital’s revenue model is primarily based on its subscription fees, although it makes a small proportion of money from transaction-based interchange revenue. The company also generates revenue by driving deposits to partner banks.

“If we charge zero, then it’s all interchange and a transaction revenue, and the problem with that is you’re not aligned with the customer,” Friedman pointed out. “[The subscription model] helps us reduce our interchange revenue by 30%. We’re working against ourselves, but what we’re really trying to do is help the customer.”

Qapital has raised $47 million in total, including a $30 million Series B round it closed in April 2018 led by Swedbank Robur, with participation from Northzone.

Bank Innovation Ignite, which will take place March 2-3 in Seattle, is a must-attend industry event for professionals overseeing financial technologies, product experiences and services. This is an exclusive, invitation-only event for executives eager to learn about the latest innovations.